What are Post-Dated Cheques?

In Odoo, cheques issued with a future date are referred to as post-dated cheques (PDCs). These cheques cannot be refunded or processed until the specified date. PDCs are commonly used for delayed payments and other deferred financial transactions.

Handling Post-Dated Cheques in Odoo

Managing PDCs robustly and efficiently can be challenging for businesses, as they require careful handling to ensure compliance and accurate financial reporting. If you’re looking for how to manage post-dated cheques in Odoo 18, this guide will walk you through every step. While Odoo does not offer default functionality for PDCs, this limitation can be addressed by creating custom journals.

Create a Journal to Manage Post-Dated Cheques

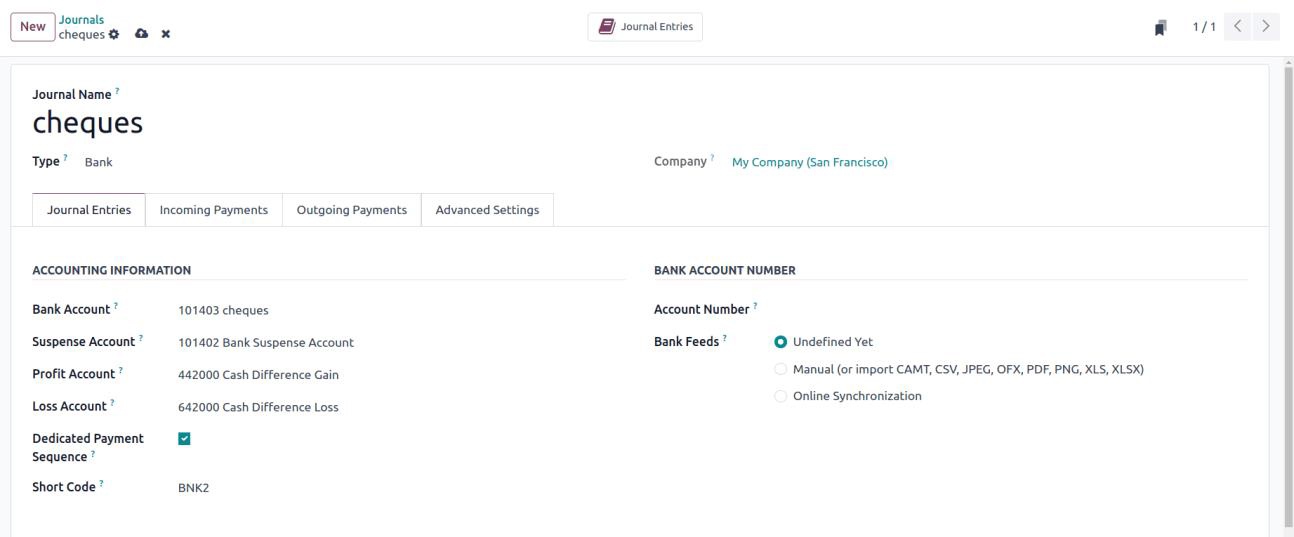

To effectively manage PDCs in Odoo, you can create a dedicated journal specifically to record PDC transactions:

- Navigate to the Accounting module.

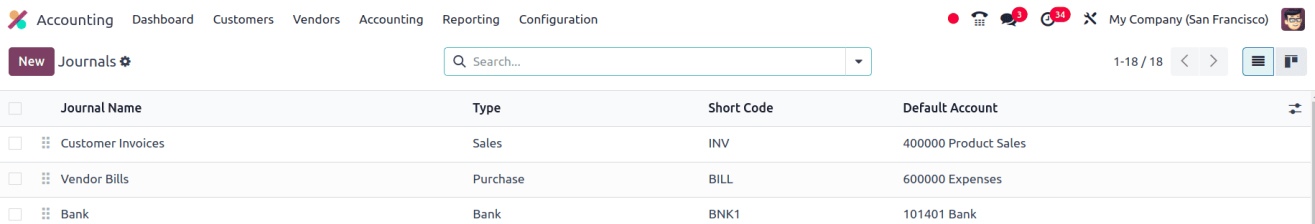

- Go to the Configuration menu and select the Journals sub-menu.

- Here, you’ll find a list of existing journals along with details such as their names, types, short codes, and default accounts.

By creating a journal exclusively for post-dated cheques, you can effectively streamline the recording and management of these payments.

Configure Payment Methods for PDCs

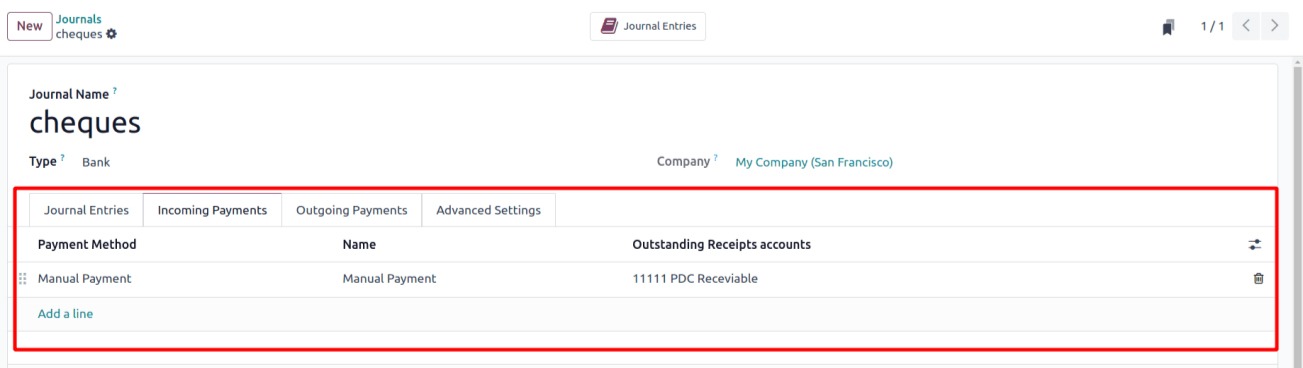

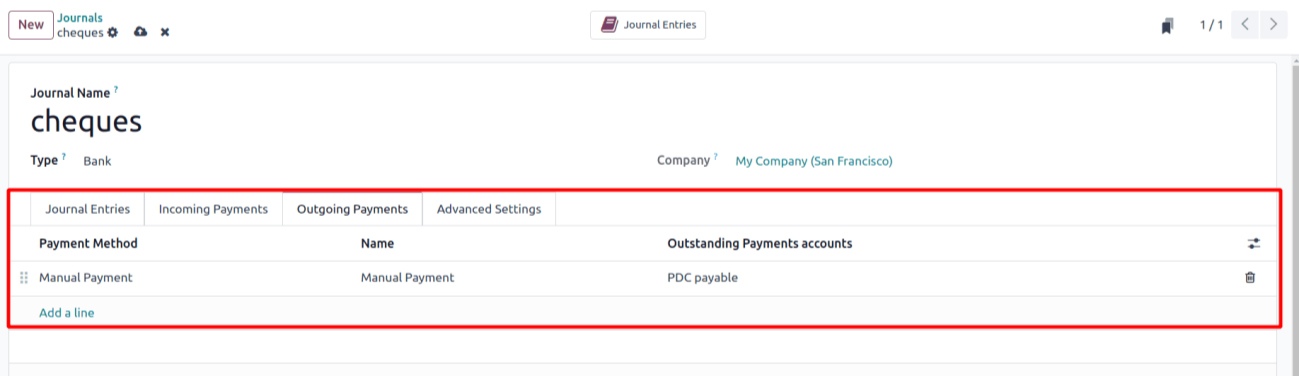

After creating the journal, configure the payment methods to better manage post-dated cheques. First, navigate to the Incoming Payments and Outgoing Payments tabs. Then:

Under the Incoming Payments tab

- Set the Payment Methods manually.

- Specify the Outstanding Receipt Account as "PDC Receivable," categorised as a current asset account.

Under the Outgoing Payments tab

- Set the Payment Methods to Manual.

- Assign the account as "PDC Payable," which represents a liability account.

Manage PDCs for Customer Invoices

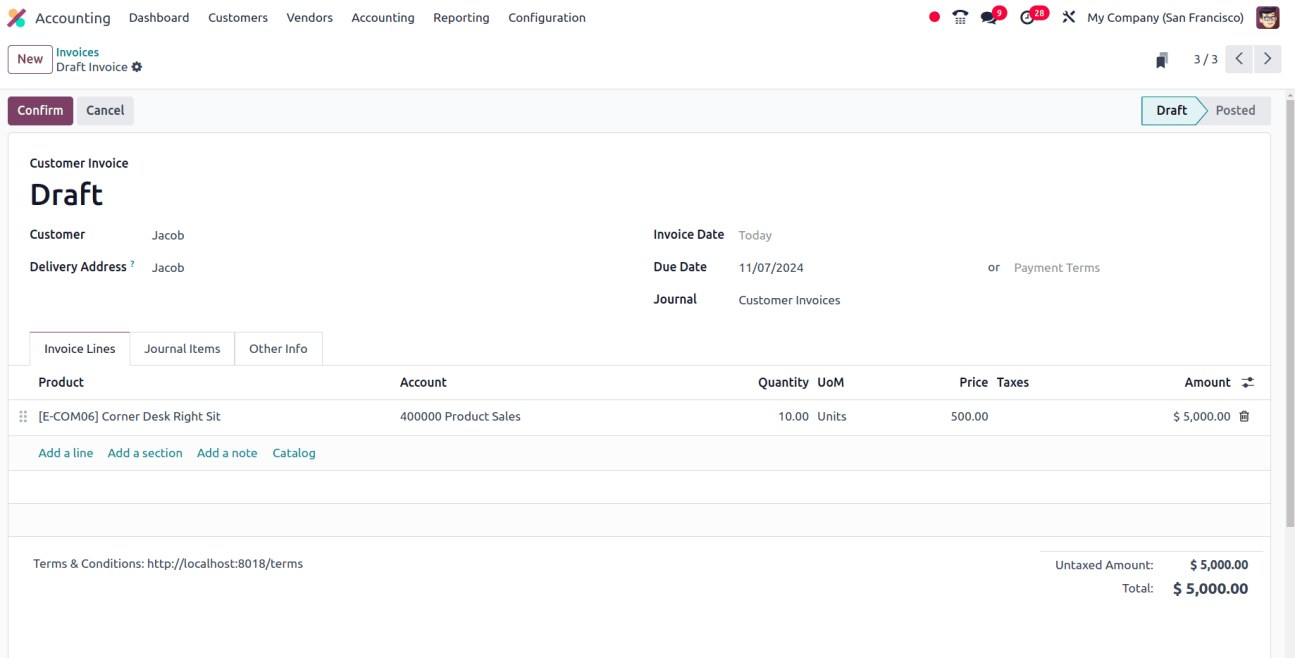

Here’s how to handle PDCs when creating customer invoices:

- Create a customer invoice and set the Invoice Date to the current date.

- Specify a future Due Date for the invoice, e.g., a seven-day gap between the invoice date and the due date.

- Confirm the invoice. Once confirmed, the invoice status will change from Draft to Posted.

If the customer pays via cheque, record the payment as follows:

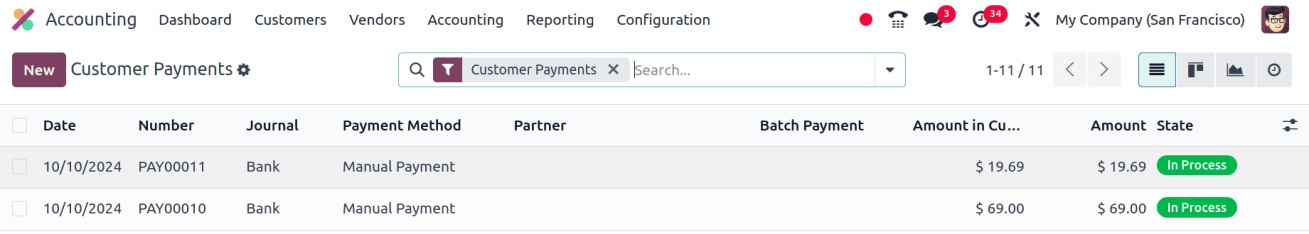

- Go to the Payments sub-menu under the Customers menu in the Odoo 18 Accounting application. This section displays all previously created customer payments.

- Click the New button to create a new payment.

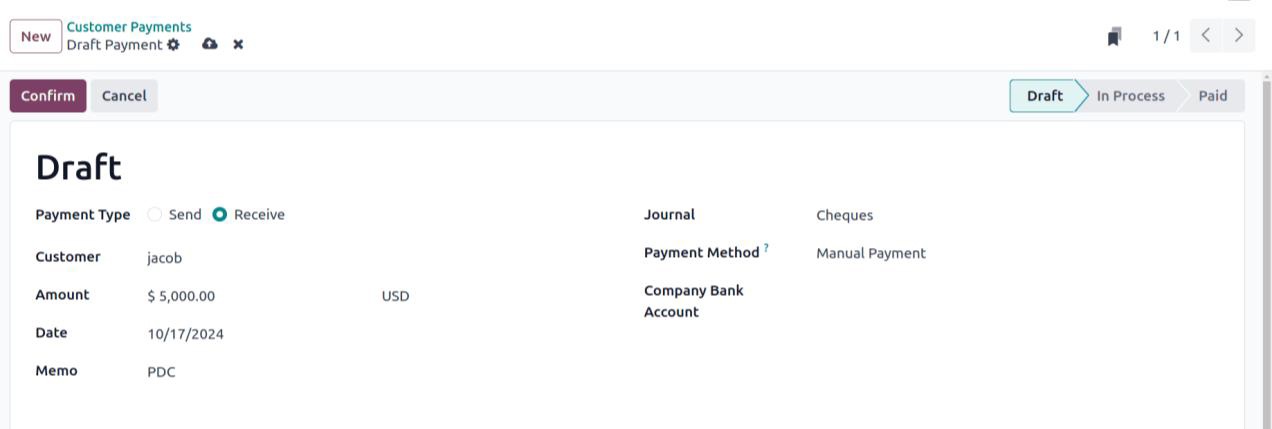

After clicking the New button, a Customer Payment form will appear. In this form:

- Set the Payment Type to "Receive" for customer payments (or "Send" for vendor payments).

- Enter the customer name, amount, and payment date to match the invoice details.

- Select the Journal as the Cheque journal previously created.

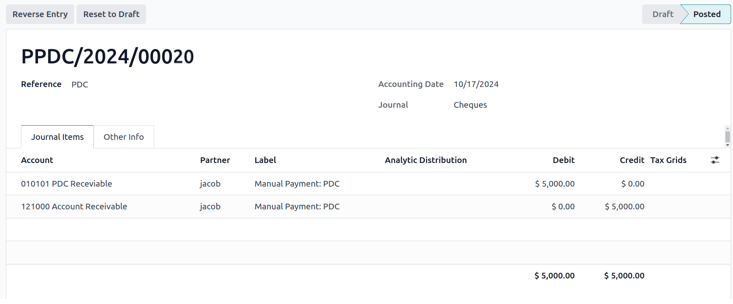

Click Confirm to move the payment from the Draft state to the In-Progress state, and then click Validate to finalise it, transitioning it to the Posted state. At this stage, a Journal Entry smart button will appear, allowing you to review the journal entry for the payment.

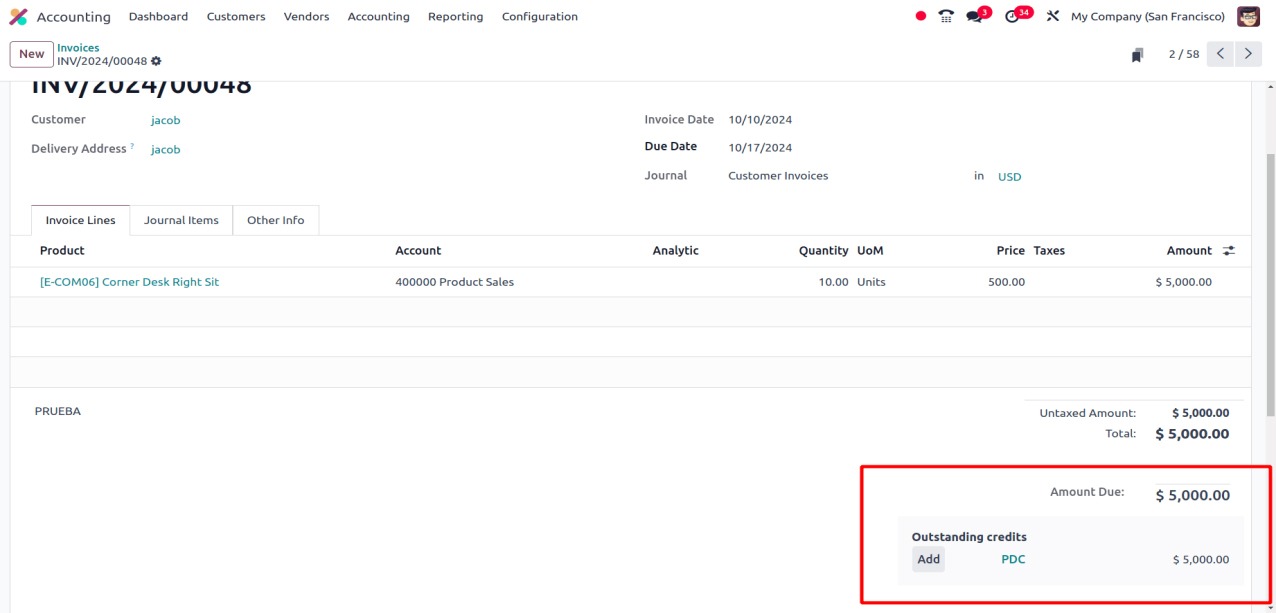

Apply the Cheque Payment to the Invoice

When you go to the Invoices section and select the invoice you created, you will see the customer's outstanding credits displayed at the bottom of the invoice page. Additionally, there will be an option to link the customer payments to the invoice.

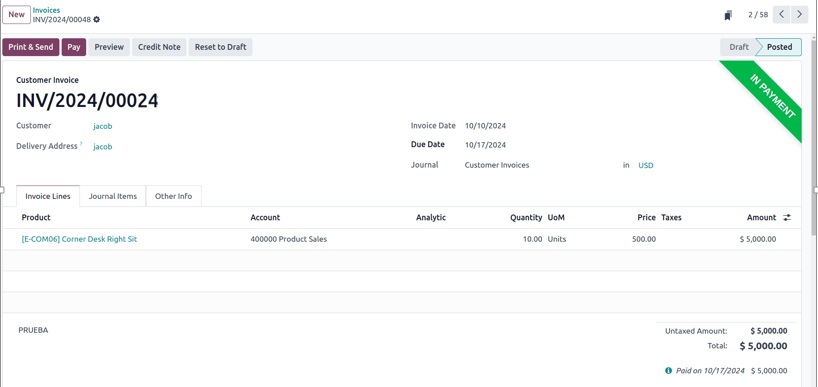

Click the Add button to apply the Cheque payment to the invoice. Once the Cheque payment is added, the invoice will move to the In Payment state.

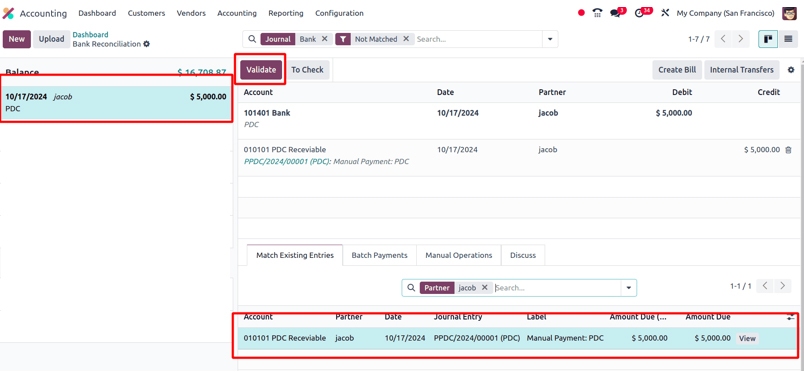

Reconcile the PDC with a Bank Statement

The final step is reconciling the PDC with the bank statement:

- Navigate to the Dashboard of the Accounting module and create a new Bank Statement.

- Validate the bank statement.

- Return to the invoice to verify its status. It should now be marked as Paid, reflecting the successful reconciliation of the PDC payment.

This is how you can manage Post-Dated Cheques (PDCs) for customer invoices in Odoo 18.

Wrap-Up

PDCs help manage cash flow more effectively by allowing payments to be planned for a later time. They also provide an additional layer of protection, as the Cheque cannot be cashed immediately. This reduces the risk of fraudulent or unauthorised use, enhancing overall security in financial transactions.