by Sajjad Hussain

Managing inter-company transactions can be a real headache for businesses. The complexities involved often result in errors and delays, impacting financial visibility and decision-making.

Streamlined inter-company transactions play a pivotal role in fostering seamless operations and maintaining robust financial health. Understanding the intricacies of debit and credit flows between entities is essential for optimizing efficiency and ensuring accurate accounting practices.

What Are Inter-Company Transactions

Inter-company transactions refer to financial activities conducted between different entities within the same organization. These transactions encompass a range of activities, including sales, purchases, refunds, and credit notes. Efficient management of these transactions is crucial for maintaining transparency, accountability, and compliance with regulatory standards.

Numla's Innovative Solution

Numla has developed a cutting-edge product designed to simplify inter-company transactions. With Numla's platform, users can easily create refunds and credit notes against other companies selected as vendors. Our innovative platform is designed to simplify these processes, automate transactions, and ensure compliance.

Debit and Credit Flow

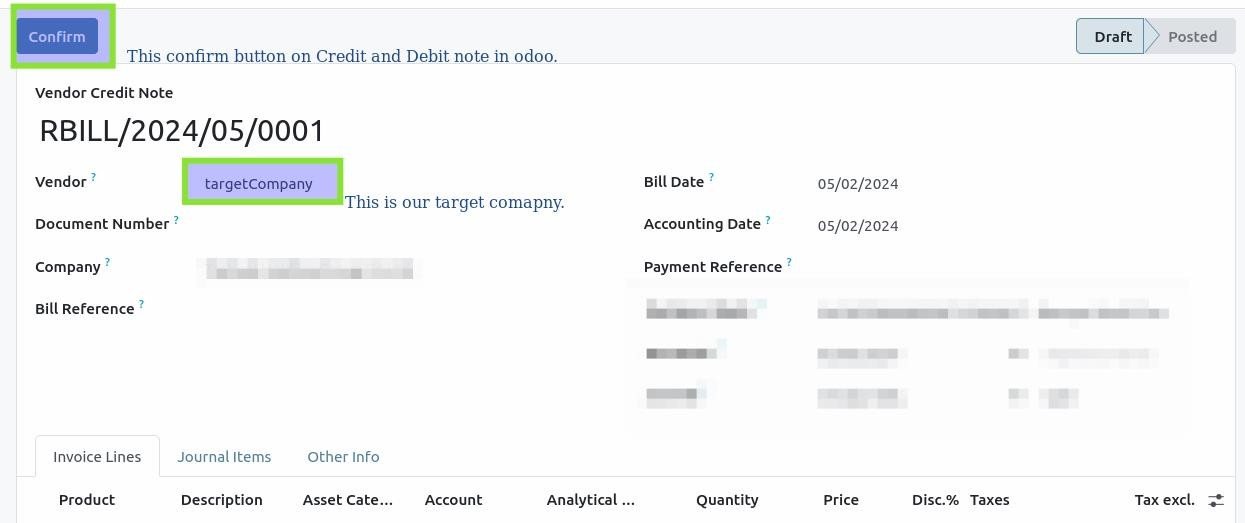

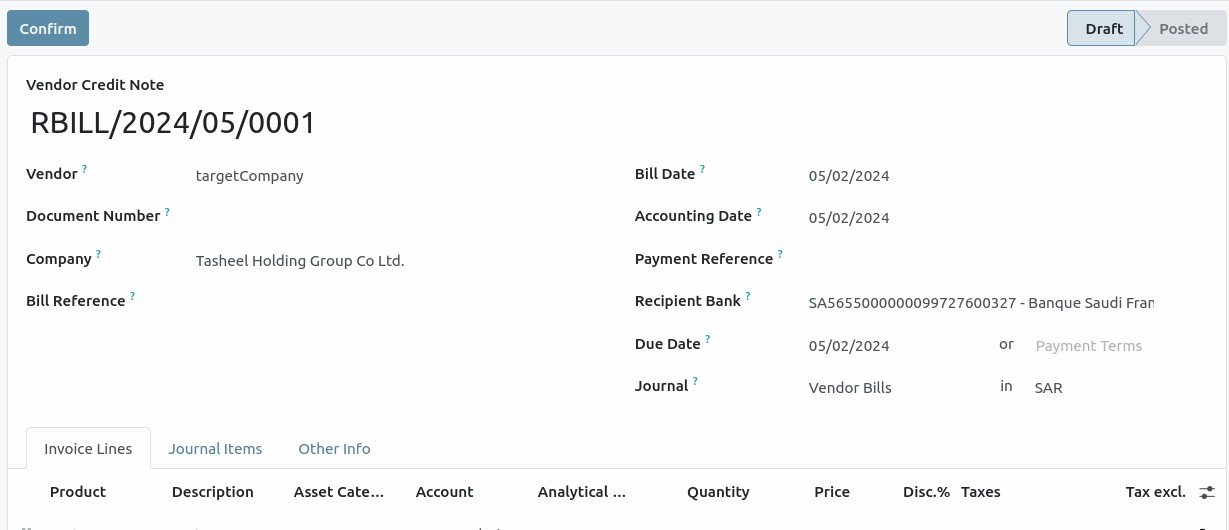

Every time a user confirms a credit note or refund, Numla's system generates two documents—one in the current company and another in the target company. This dual-documentation approach ensures comprehensive recording of transactions and facilitates reconciliation across entities.

Automatic Generation of Documents

In the case of creating a refund in the current company, the system automatically generates a corresponding credit note in the target company. Similarly, when a credit note is created and confirmed in the current company, the system promptly generates a refund in the target company.

This automated process eliminates manual intervention, minimizes errors, and accelerates transaction processing.

Enhanced Communication through Chat Integration

To further streamline communication and collaboration, Numla's system seamlessly integrates with chat functionality. Whenever a credit note or debit note is created automatically by the system, it adds a notification message in the chat, ensuring stakeholders are promptly informed of transactional activities.

Conclusion

Efficient management of inter-company transactions is essential for modern businesses seeking to optimize processes, enhance financial visibility, and drive growth. Numla's innovative solution empowers organizations to streamline debit and credit flows, automate transactional processes, and foster seamless collaboration across entities.

By using Numla's platform, businesses can unlock new levels of efficiency and effectiveness in managing inter-company transactions.

Transform your financial management

Experience the benefits firsthand in a personalised demo.