Chart of Accounts in Odoo

A chart of accounts (COA) is a list of all the accounts that an organisation uses to record its financial transactions. It is a systematic and organised way of categorising and tracking all financial activities of a business. The chart of accounts serves as the foundation for an organisation's financial reporting. It allows accountants and financial professionals to record transactions in a standardised way, so they can be easily understood and analysed.

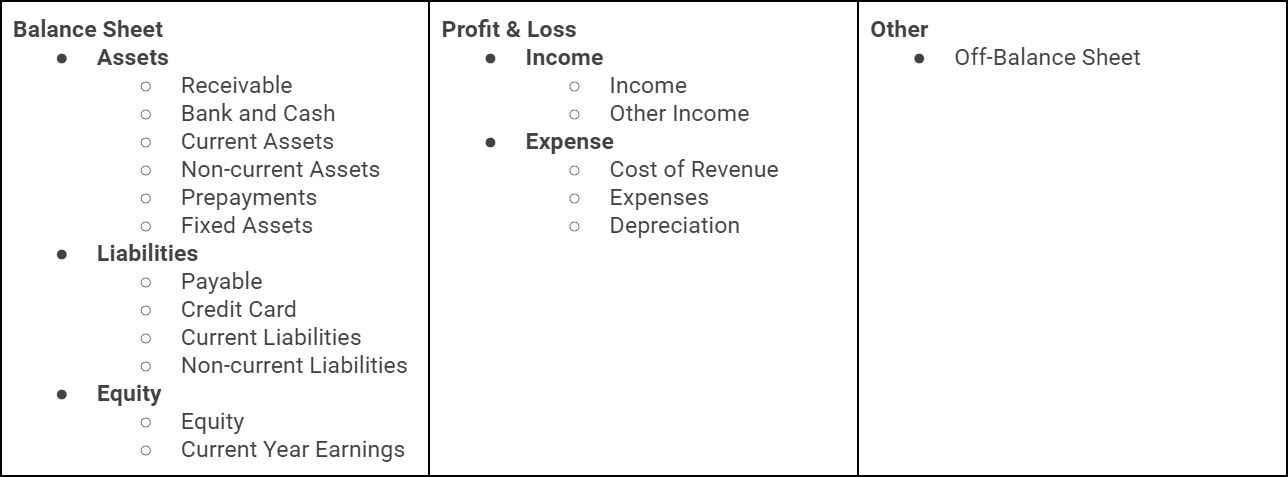

In Odoo, the chart of accounts provides a framework for organising financial transactions by categorising them into different types of accounts, which are as follows:

Each account type in the chart of accounts should have an account code range and unique name per chart of accounts. The top type of chart of account defines that the accounting effect will come up in which financial report.

The COA can be customised to fit the needs of a specific business, with accounts added or removed as necessary. In addition, the COA can be structured hierarchically, with a chart of account groups, providing even more detailed information on a company's financial transactions.

Like in other ERPs, Odoo doesn’t require you to define a chart of accounts with parent-child hierarchy. Odoo requires the user to define the transactional chart of accounts, the hierarchy can be defined using the chart of account groups.

Default Accounts

Required for Automated Transactions

There are some charts of accounts that are required by Odoo to smoothly create automated accounting transactions without any errors or issues. For example, to record inventory valuation in the system automatically, you need to define the following against a product category where you want to activate the automated valuation:

1. Stock Journal

This is the accounting journal in which the accounting entries will be automatically posted when stock moves are processed.

2. Stock Valuation Account

This account will hold the inventory value of the products.

3. Stock Input Account (Stock received but not yet billed)

Counterpart journal items for all incoming stock moves will be posted in this account unless there is a specific valuation account set on the source location. This is the default value for all products in this category. It can also be directly set on each product.

4. Stock Output Account (Stock delivered but not yet invoiced)

Counterpart journal items for all outgoing stock moves will be posted in this account unless there is a specific valuation account set on the destination location. This is the default value for all products in this category. It can also be directly set on each product.

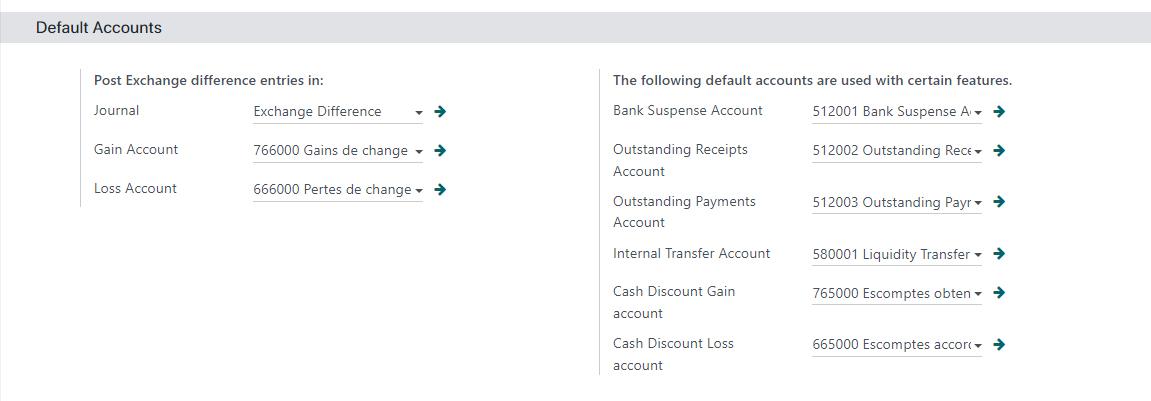

The following are other default accounts required to properly set up accounting:

Each one of the above

is being used on specific automated actions, for example, the currency exchange

differences are auto-recorded (when observed) using these default charts of

accounts.

Why use Odoo's Chart of Accounts?

Overall, the chart of

accounts is an essential tool for managing financial data and ensuring accurate

financial reporting. By using the Odoo chart of accounts, organisations can

ensure that their financial transactions are properly recorded and tracked and

that financial reports are accurate and easy to generate.