VAT in Odoo

by Shahzeb Khan

Managing taxes can be one of the most challenging aspects of running a business, especially when it comes to Value Added Tax (VAT). For many, VAT is a bit of a mystery— a necessary but often confusing part of business operations. Thankfully, Odoo offers tools to make VAT management easier and more efficient. In this article, we'll explore how Odoo can help you manage VAT without stress, making it simpler to stay compliant and keep your business running smoothly.

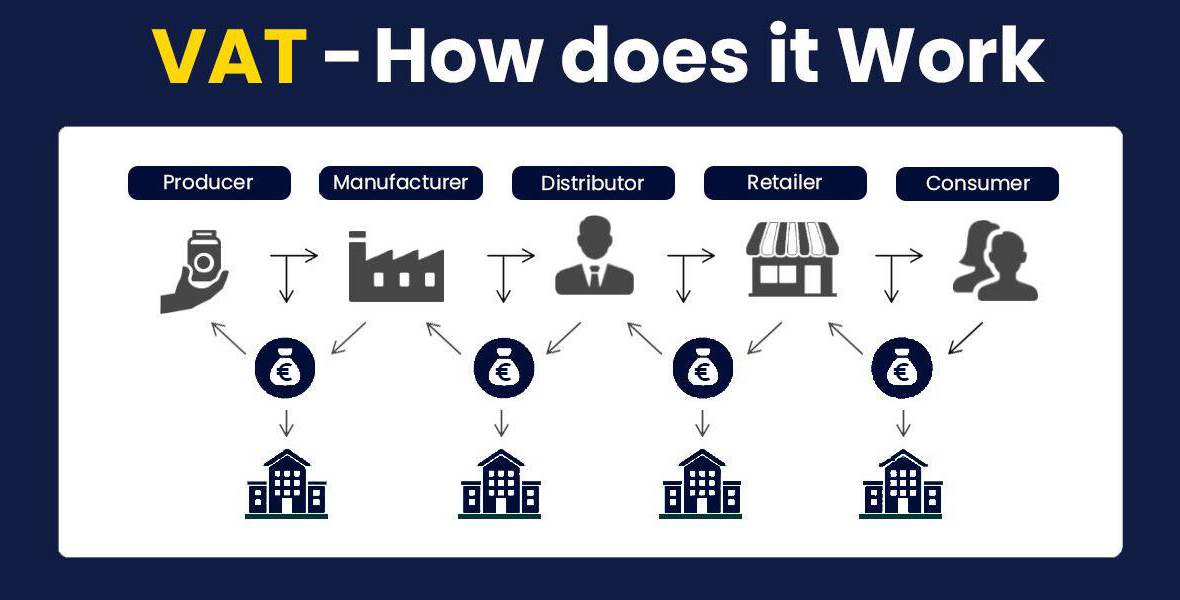

What Is VAT and Why It Matters

VAT, or Value Added Tax, is a tax on goods and services that’s collected at every stage of production and distribution. If you’re selling products or services, you probably charge VAT, collect it from your customers, and then remit it to the tax authorities. At the same time, you can usually reclaim the VAT you’ve paid on your business expenses. While it sounds straightforward, VAT can get complicated quickly, especially with different rates, exemptions, and international rules to navigate.

This is where Odoo steps in. Odoo’s tools are designed to take the complexity out of VAT, helping you manage it in a way that’s clear, organised, and easy to understand.

VAT Configuration in Odoo

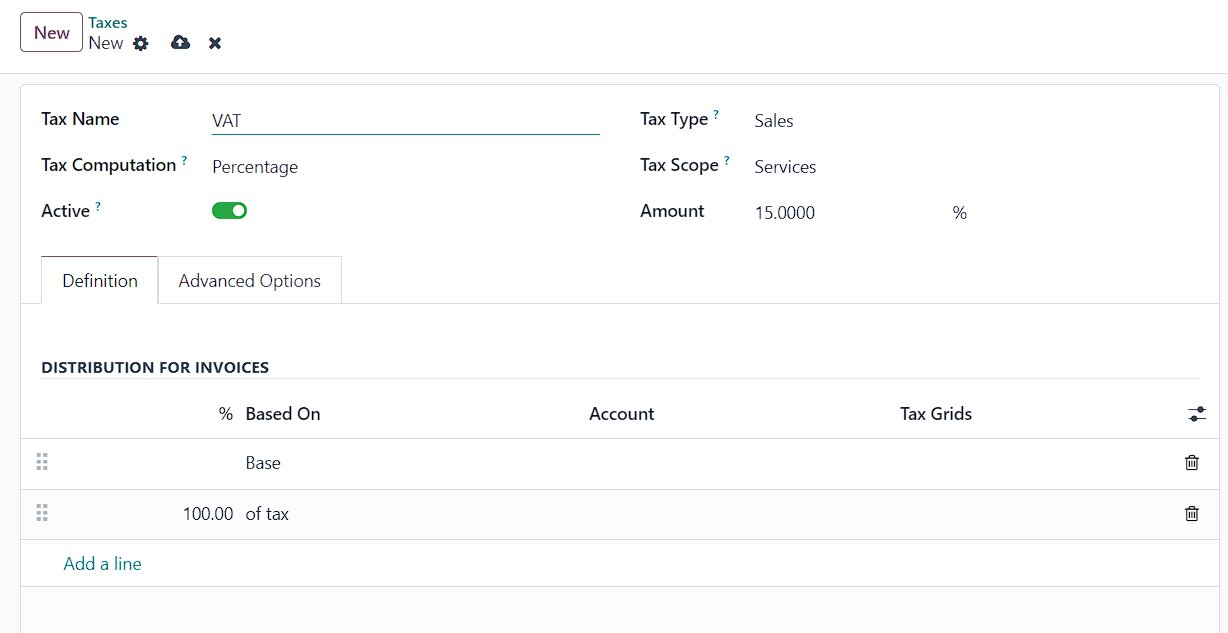

Starting with Odoo is like having a guide walk you through the maze. When you first set up your VAT in Odoo, the system helps you configure everything according to your specific needs—whether you’re dealing with standard VAT rates, reduced rates, or even different rules for various countries.

Odoo’s intuitive design ensures that even if you're new to VAT management, setting up your tax accounts and rules feels straightforward. It’s simple to set up tax accounts, define whether your prices include VAT or not, and ensure that VAT calculations are automatically applied to your invoices and sales orders. Even if you’re not a tax expert, Odoo helps make sure you’re doing things right from the start.

VAT Reporting

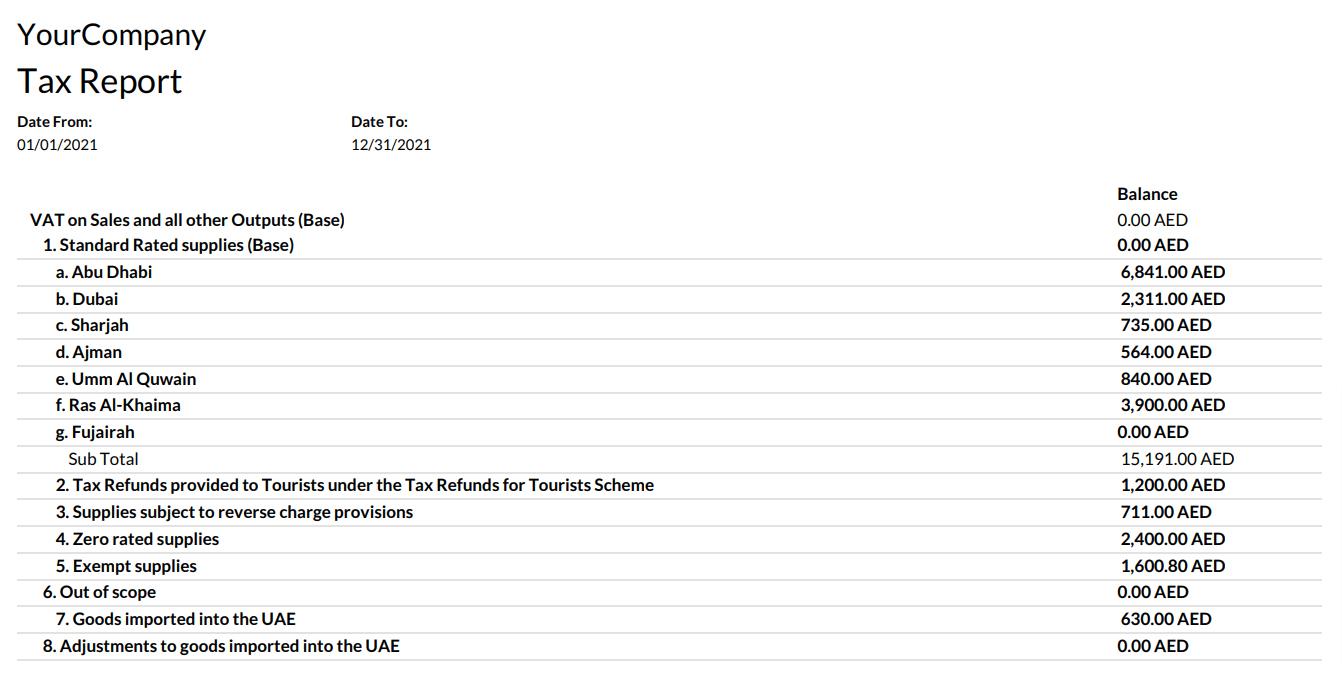

Generating VAT reports for tax authorities is often one of the most time-consuming aspects of tax management. These reports need to be accurate, and errors can lead to fines or audits. Odoo takes this burden off your shoulders by automating VAT reporting. With the data from your daily transactions, Odoo can generate VAT reports that meet the specific requirements of your country or region.

This means you can spend less time worrying about paperwork and more time focusing on your business. Plus, automated reports reduce the risk of mistakes, helping you avoid any unpleasant surprises down the road.

Managing International VAT with Odoo

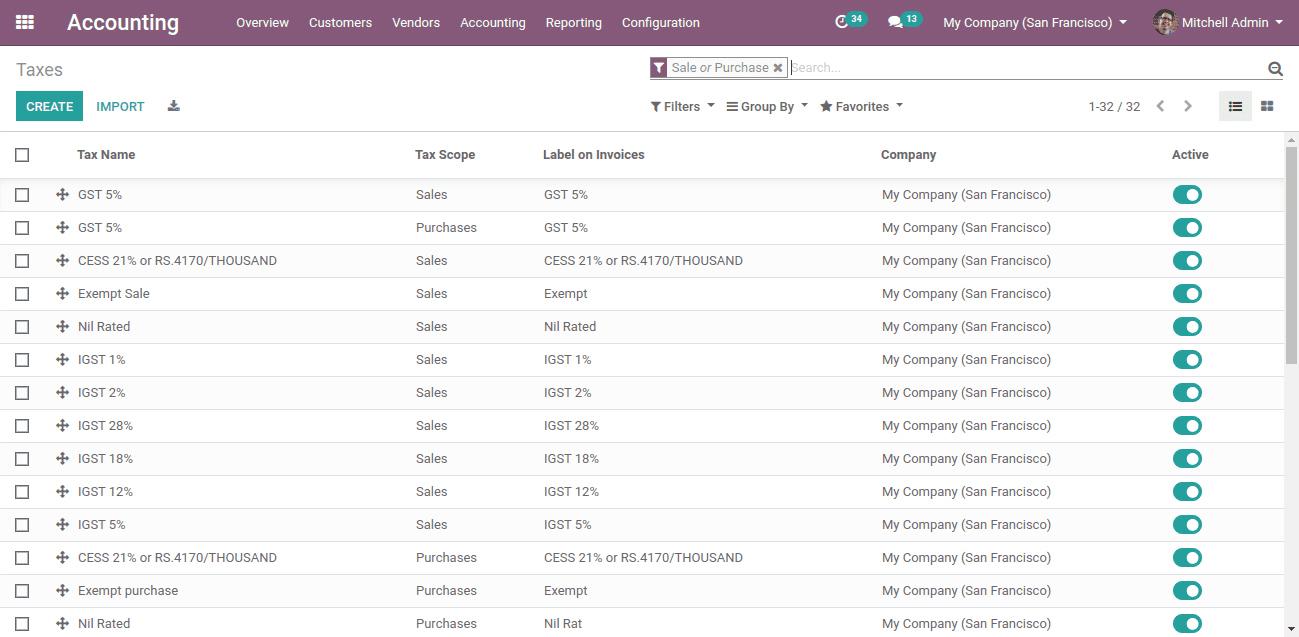

If your business operates internationally, VAT can get even more complex. Different countries have different VAT rates, and there are special rules for things like exporting goods or trading within the European Union. Odoo makes managing international VAT simpler by allowing you to set up multiple tax rates for different countries. It even automatically applies the correct rate based on where your customer is located.

With Odoo’s automation, the complexities of international VAT are managed seamlessly. This feature is a game-changer for businesses that are expanding globally. You don’t have to be a VAT expert in every country you operate in—Odoo handles the details, so you can focus on growing your business.

Odoo’s Flexibility and Integration

As your business grows, your needs will change. What’s great about Odoo is that it grows with you. Whether you’re adding new products, expanding into new markets, or just needing more advanced VAT features, Odoo is flexible enough to adapt. And because Odoo integrates VAT management with your business’s accounting, inventory, sales, and other key functions—you can be confident that everything is working together seamlessly.

This integration helps ensure that your VAT management stays accurate and efficient, no matter how complex your business becomes.

Conclusion

Dealing with VAT doesn’t have to be a headache. With Odoo, you have a tool that makes VAT management straightforward and stress-free. Whether you’re just starting or looking to simplify your existing processes, Odoo offers the flexibility and support you need to stay on top of your VAT obligations.

Want to customise Odoo for your business?

We can tailor Odoo to meet your specific needs.