Overview of Costing Methods in Odoo 18

Costing methods in Odoo 18 determine how product costs are calculated and monitored in inventory management. The main approaches available are FIFO (First In, First Out), AVCO (Average Cost), and Standard Costing. These methods directly influence inventory valuation and financial accounting, ensuring accurate cost tracking for effective profitability analysis.

Standard Costing

Fixed cost manually specified for products.

Average Cost

Costs are based on the average of all purchases.

First In, First Out

Costs are based on the oldest stock acquired.

Detailed Explanation of Costing Methods

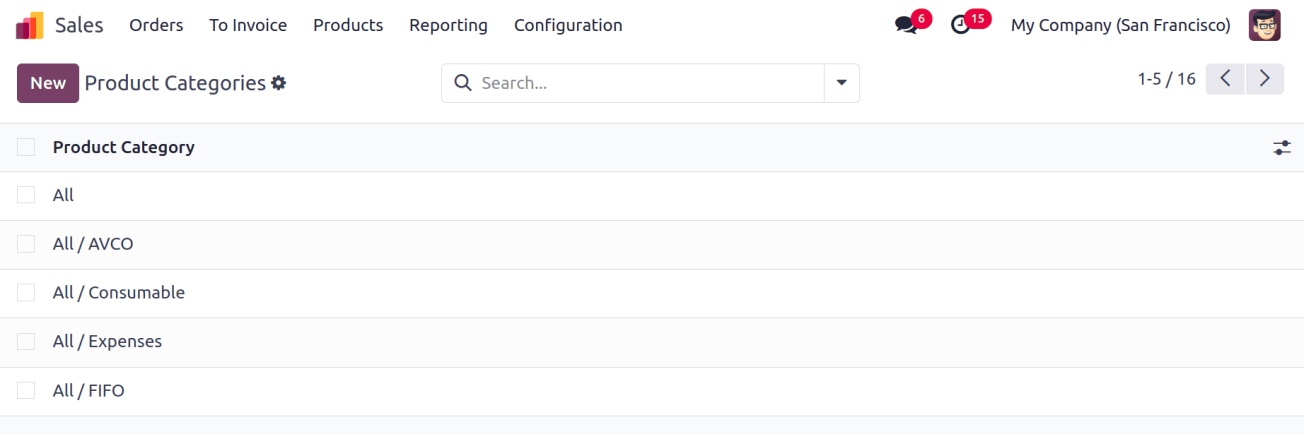

Let’s now examine how the various costing methods operate in Odoo 18. The costing methods are defined within the Product Category. To configure them, navigate to the Configuration menu and select Product Category.

Configuration > Product Category

Here, you can choose one of the costing methods for each product category you wish to configure.

1. Standard Price Costing

The standard price is straightforward to understand. The purchase order price does not affect the standard pricing. In other words, it simply uses the cost field, and delivery or purchase receipts do not impact the cost. In the case of standard price product costing, the cost price is typically updated manually. The product price generally changes once a year or after a specific period.

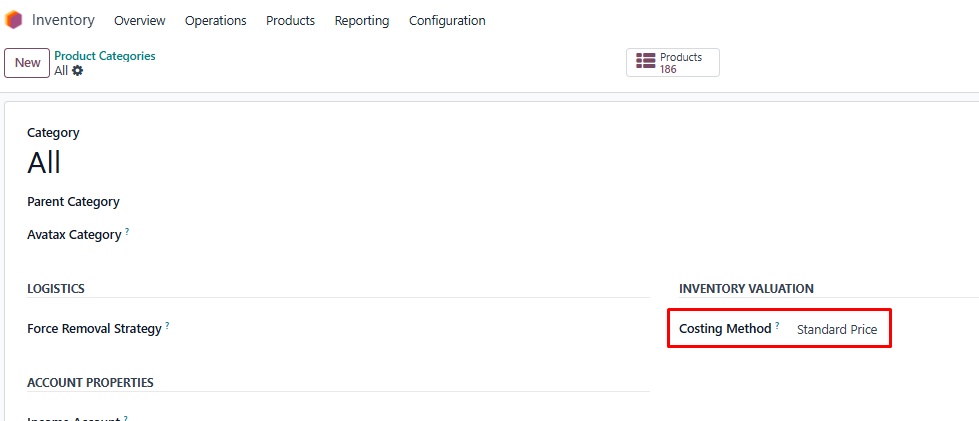

For the product category selected as 'All,' the Costing Method is set to 'Standard Price,' as shown in the screenshot below.

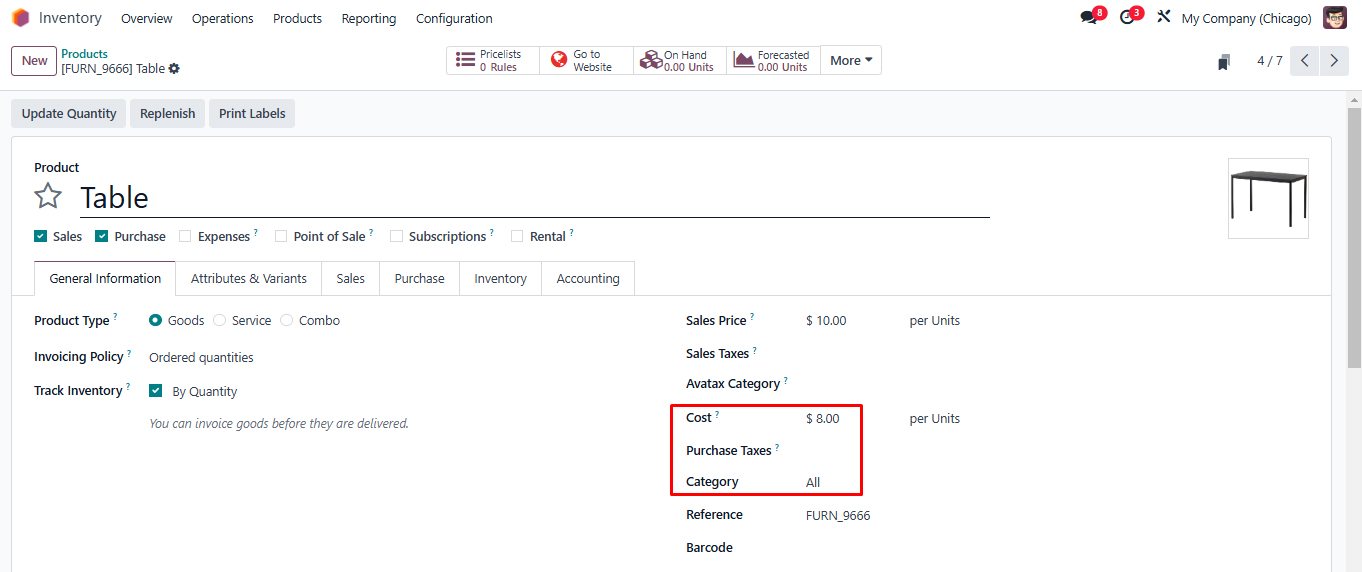

As illustrated below, let’s create a new product and set the costing method to 'Standard Price.' The product is named 'Table,' and its cost is $100. The selected product category is 'All,' as shown here.

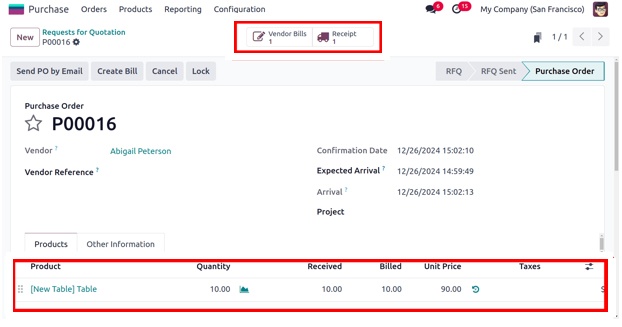

To verify the standard pricing approach, save the product and create a purchase order for the goods. The vendor is Abigail Peterson, and the 'Table' product is selected in the product lines. We are purchasing 10 quantities at a cost of $90 each.

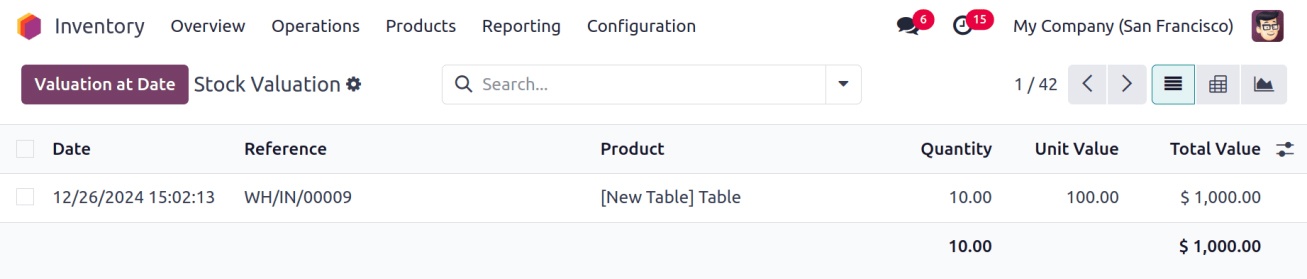

Confirm and validate the receipt to receive the product. Then, to complete the process, create a bill and finalise the payment. Let’s now examine the inventory valuation generated for the 'Table' product once the purchase order has been confirmed and validated.

The product Table cost us $90, but when reviewing the Inventory Valuation report, the user discovered that, for one quantity, the value contributed was $100 instead of $90.

Therefore, the product's standard price is used for the Standard Costing Method. The amount you paid for the item is not factored into the inventory valuation. Instead, it immediately uses the price entered in the product master.

2. Average Costing Method

The Average Costing method determines the cost of inventory items by using the average cost of all comparable, readily available items in stock. It is calculated by dividing the total value of items in stock by the quantity of products available. The cost is adjusted each time the product is purchased and received, based on the quantity ordered and the purchase order payment. However, once the products leave the warehouse, the cost remains the same.

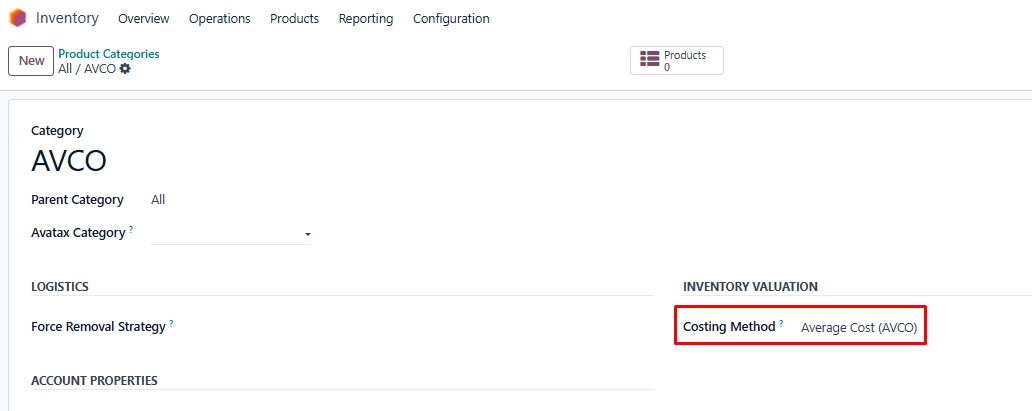

First, check the Product Category. The costing method should be set to the Average Costing Method.

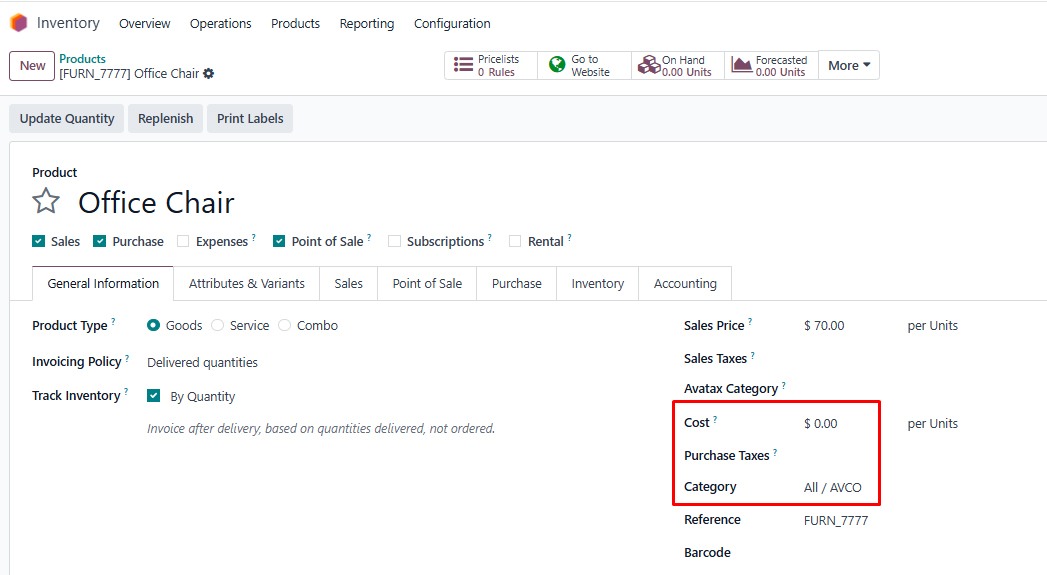

As illustrated below, let’s create a product with the product category set to 'Average Costing.' The product name is 'Chair,' and no cost is set for the product.

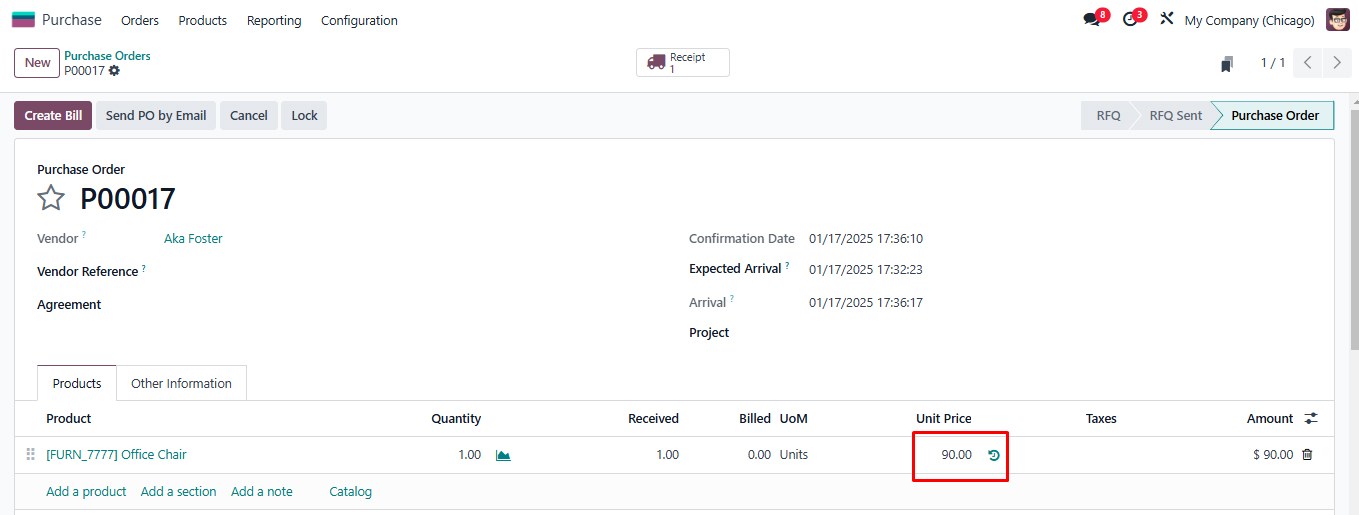

To verify the procedure, let’s create a purchase order for ten chairs at a unit cost of $90 and validate the order. Aka Foster is the supplier in this case. Then, create a bill and complete the payment process.

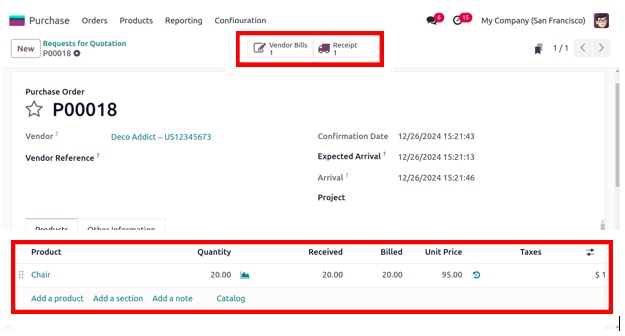

The order for the 'Chair' product has been created, with Deco Addicts selected as the vendor this time. The user paid $95 per unit for 20 units.

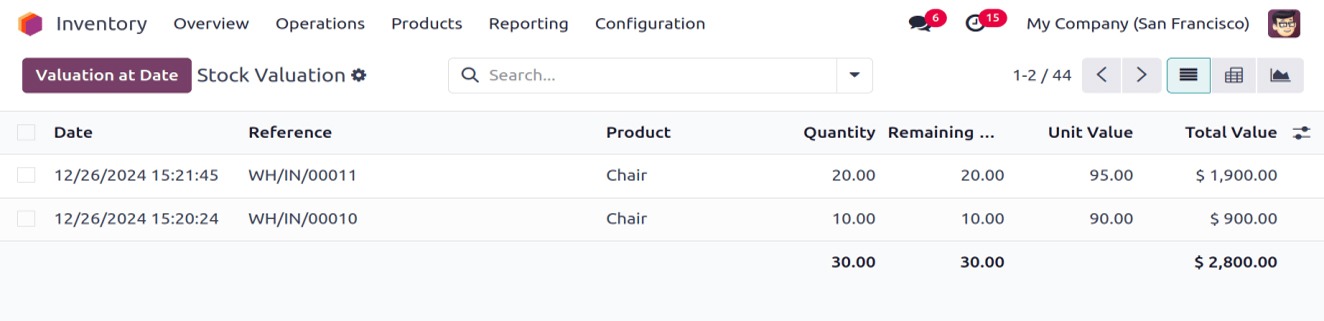

Let’s examine the inventory valuation generated for the orders in the inventory module after verifying the receipts.

We bought 10 units of a Chair at a purchase price of $90 in the first purchase order. In this case, the unit cost is $90, and the stock value is $900. Although the purchase price increased to $95, the second purchase order contains 20 units, bringing the total value to $1,900.

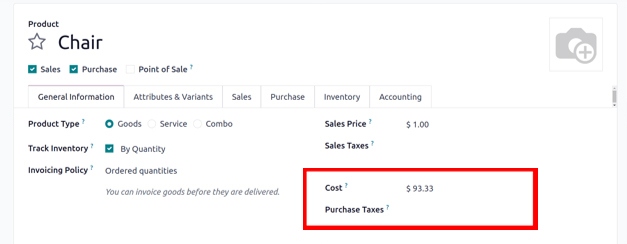

Check the product form and the product cost.

The stock values for the first and second purchase orders ($900 + $1900) add up to $2800, which is the stock value for the unit cost. Because the total quantity is 30 and the stock value is $2800, the product cost is $93.34.

3. FIFO Costing Method

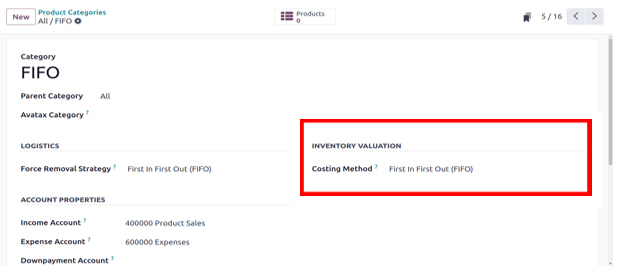

With this method, the cost price of a product is adjusted based on the last item in stock. Costing methods like FIFO (First In, First Out) impact the pricing. Therefore, select the Product Category again and set the Costing Method to 'First In, First Out'.

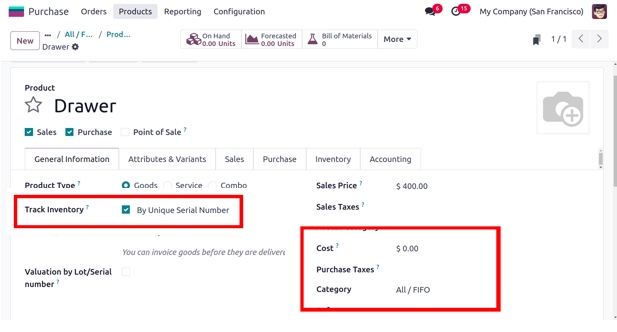

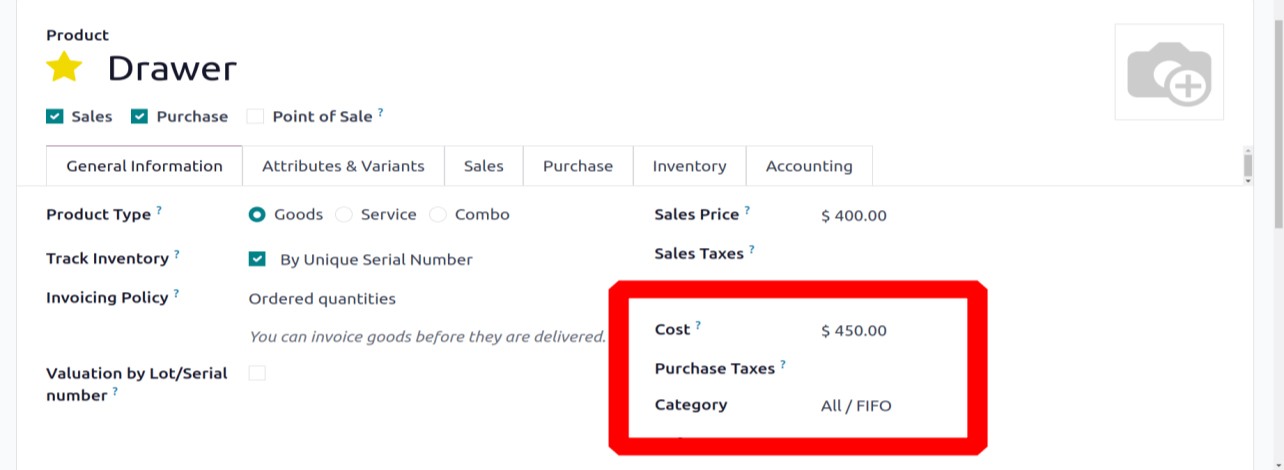

Let's design a product with a FIFO costing mechanism and a FIFO removal strategy to carry out this process. The product is named Drawer, and the product is tracked by a Unique Serial Number. There is no cost set for the product.

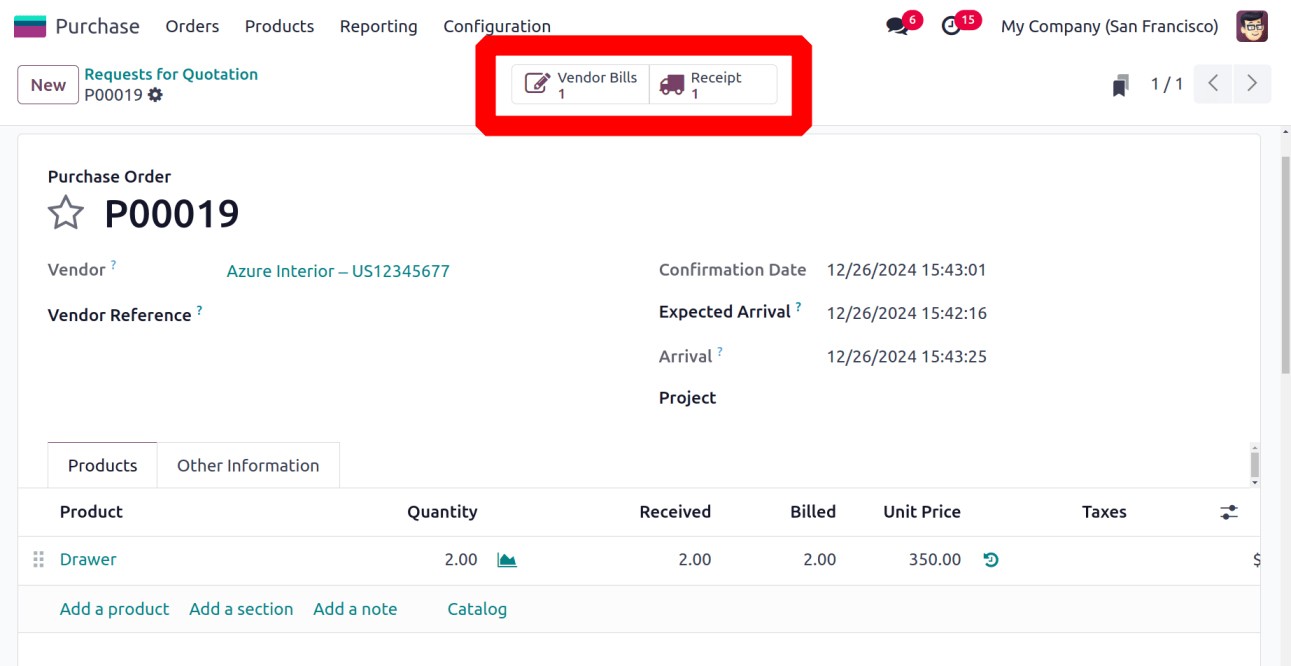

Let’s now create a purchase order for two units of the goods at a unit price of $350 to test how this costing method operates. The selected vendor is Azure Interior.

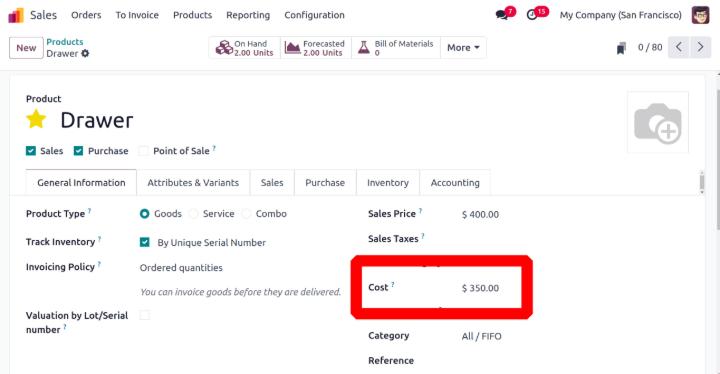

Check the unit cost of the product Drawer. Here, the purchase cost is automatically updated to $350.

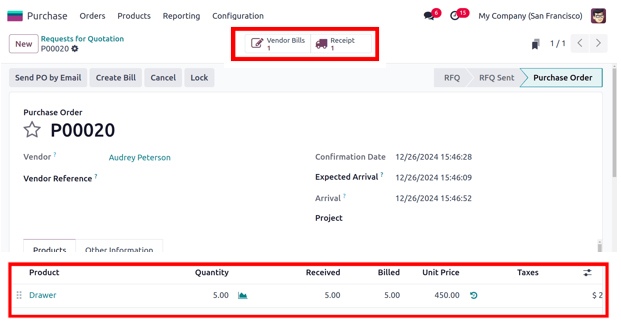

Let's now draft a new buyer order for five units of the goods, each costing $450. Verify the receipt and settle the purchase invoice.

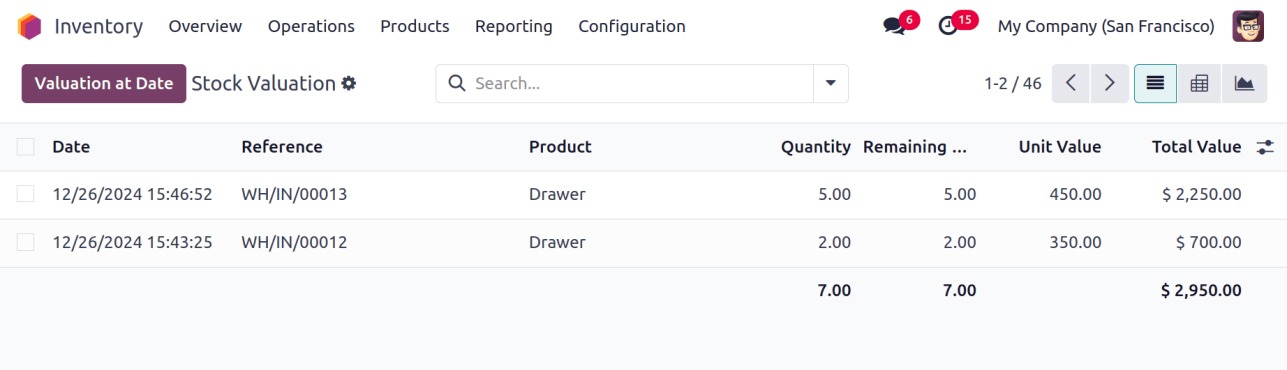

Verify and confirm the transfers. After that, as indicated below, let's examine the inventory valuation of the transfer that was generated by the inventory module.

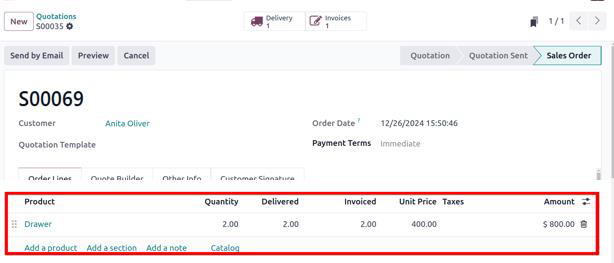

Let’s now create a sales order for two units at a unit price of $400, as shown below, to observe how this costing method operates.

Verify and confirm the sale order. If we examine the product after the transfer has been validated, the product cost will be changed to $450, as indicated below.

Therefore, the cost price of the product remains the same until it is removed from stock using one of the removal methods.

In Summary

Odoo 18 offers three distinct costing methods—Standard Costing, Average Costing, and FIFO—that help businesses track inventory and manage product costs effectively. By setting the appropriate costing method for your product categories, you can ensure accurate financial reporting and improve inventory management. Each method has its advantages, depending on your business needs, and Odoo’s flexibility allows for easy configuration and adjustments as required.

Enhance Your Odoo Experience

Simplify your operations with Numla's tailored Odoo solutions.