Eliminate Payroll Headaches with a Reliable Payroll App

Manage payroll, pay your employees, and handle taxes easily — all in one convenient payroll app.

Smart payroll software for your business

Looking for a reliable, convenient way to manage your company's payroll? Get the Numla HR Payroll App! Our payroll solution simplifies the payroll process so you can focus on running your business. With features like payslip analysis, automated tax calculations, and seamless payroll submission to revenue authorities, our payroll app has everything you need to manage and run full payroll activities in-house securely.

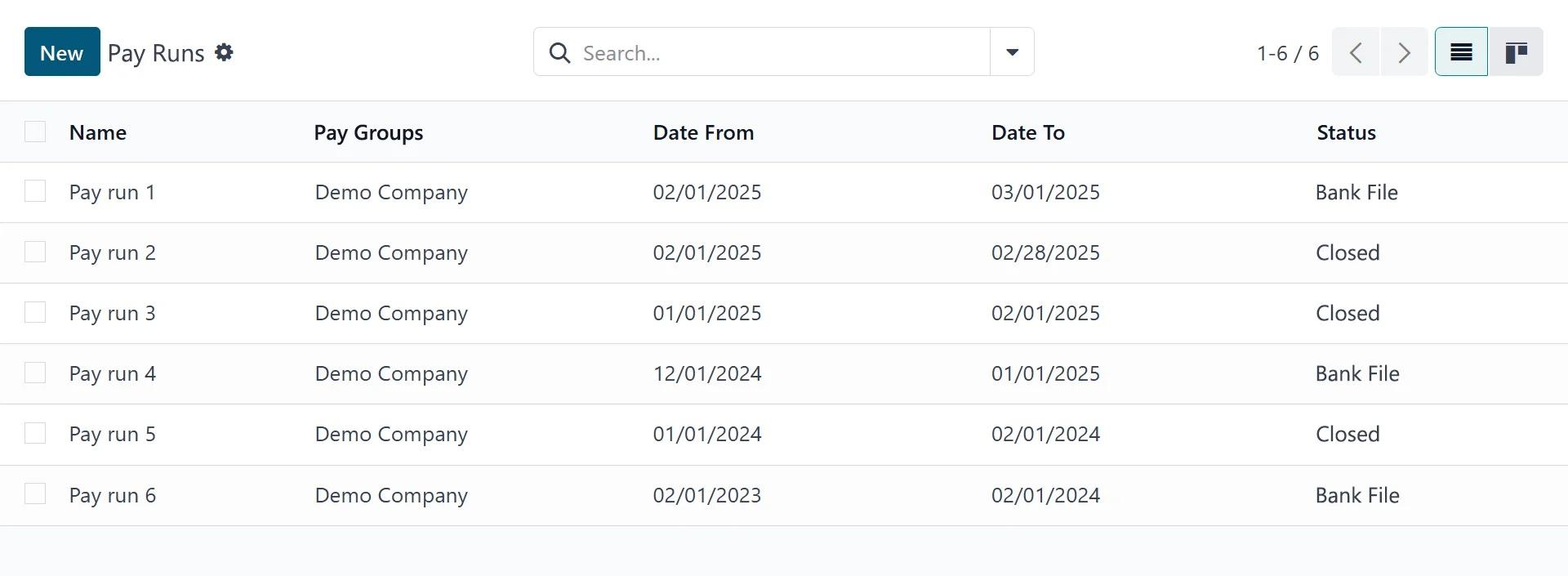

Process unlimited pay runs

Quickly process payroll for specific employee groups with the Pay Run feature. Whether you need weekly, fortnightly, or monthly payroll runs, our payroll app simplifies the process and eliminates the hassle of manual calculations.

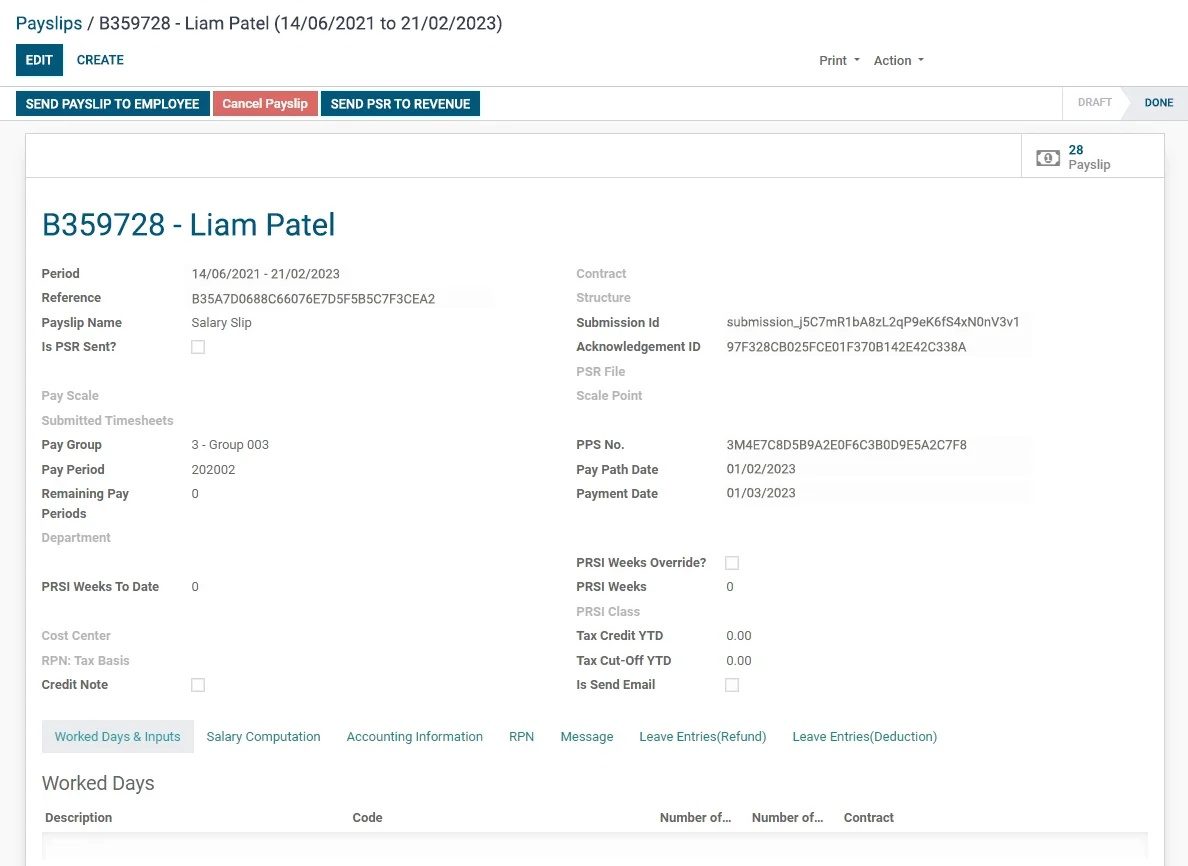

Send payslips & PSR

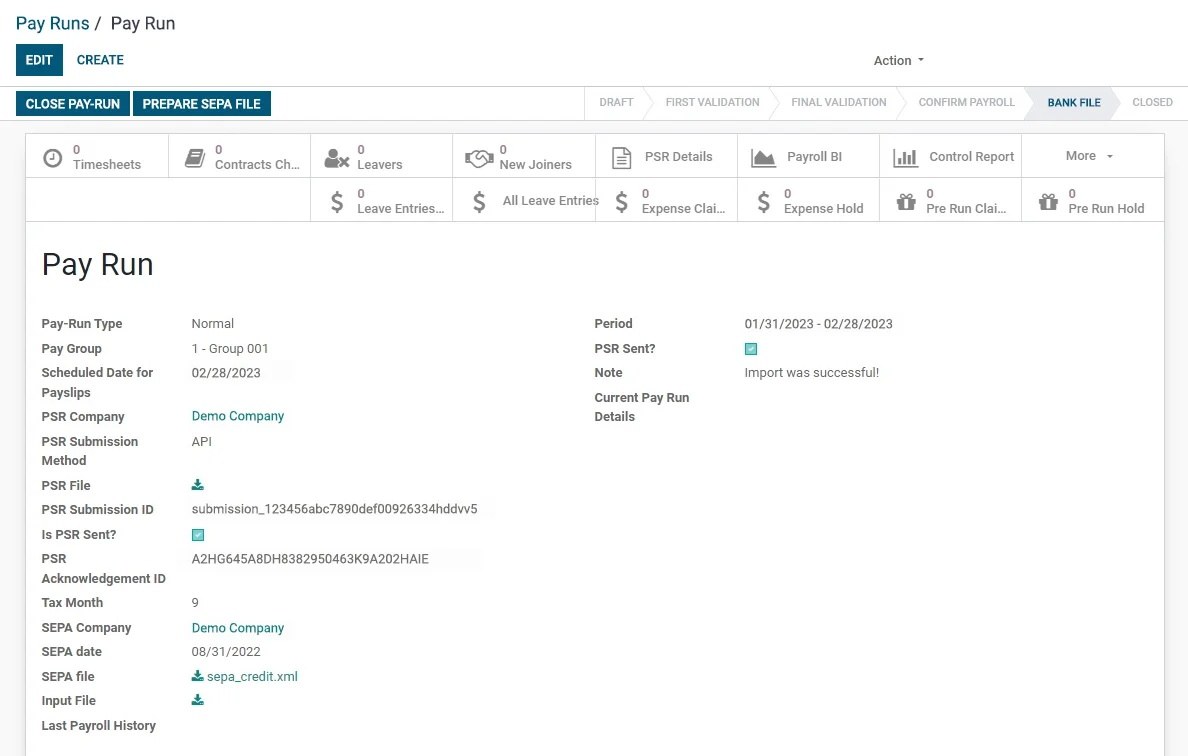

Send payslips to employees individually or in bulk with a few clicks.

Cancel or adjust payslips as needed.

Submit Payroll Submission Requests (PSR) to tax authorities.

Ensure accurate and compliant payroll processes while maintaining timely communication with employees and revenue authorities.

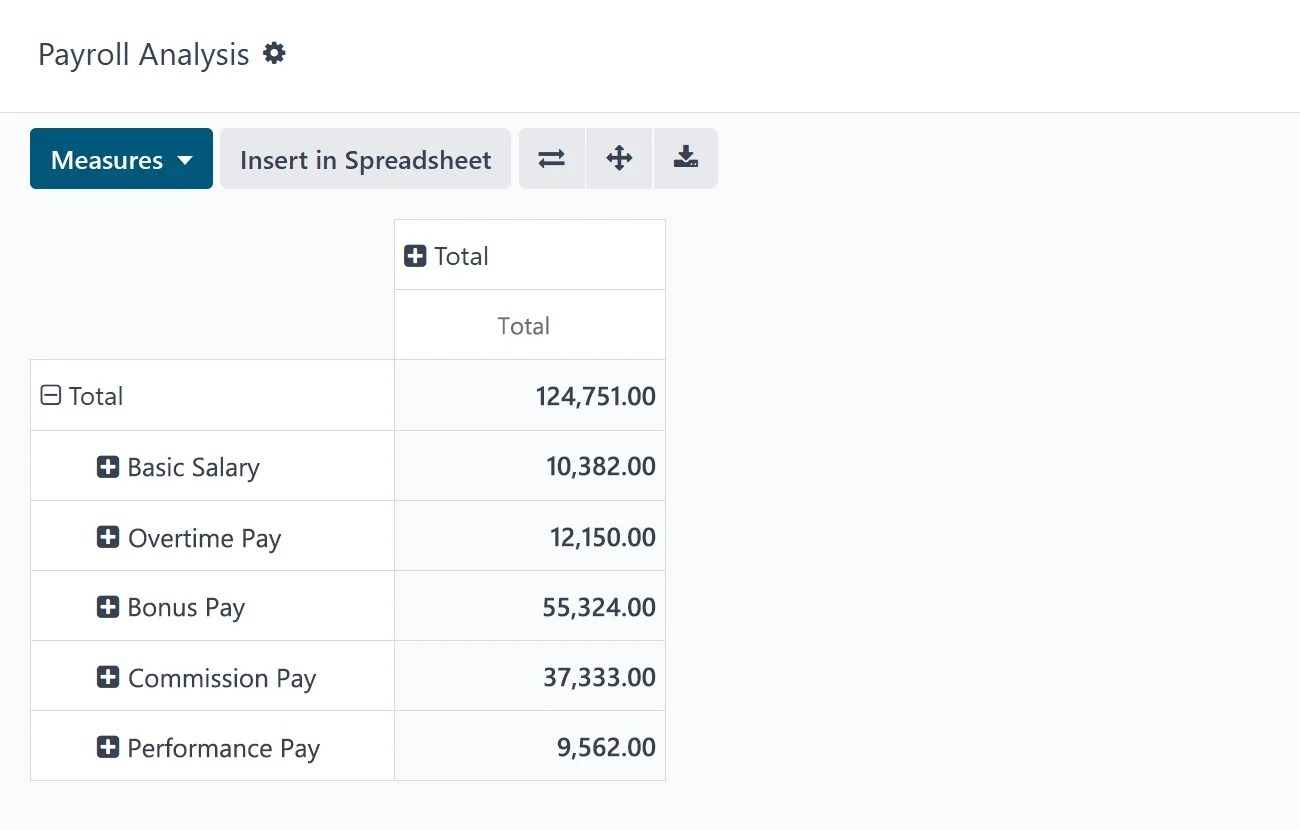

Get a detailed payslip analysis

Gain a full overview of your employees’ pay details with the payslip analysis feature. From acting allowances and bonuses to attendance allowances, our payroll app provides a comprehensive breakdown of all pay components in one convenient view.

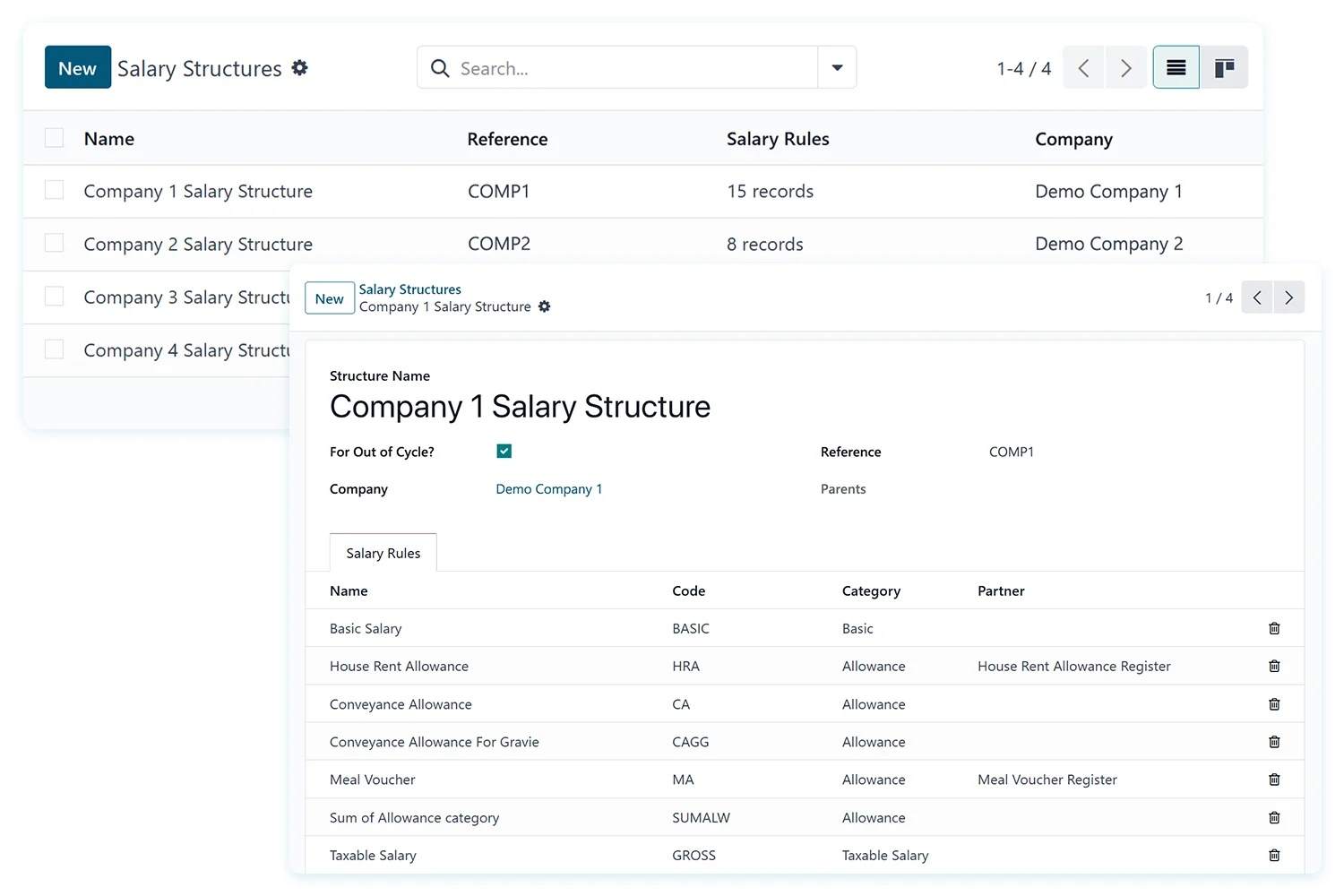

Manage salary structures

Easily view and manage salary structures. Access all necessary employee compensation details, including company information, references, and salary rules, directly in the app.

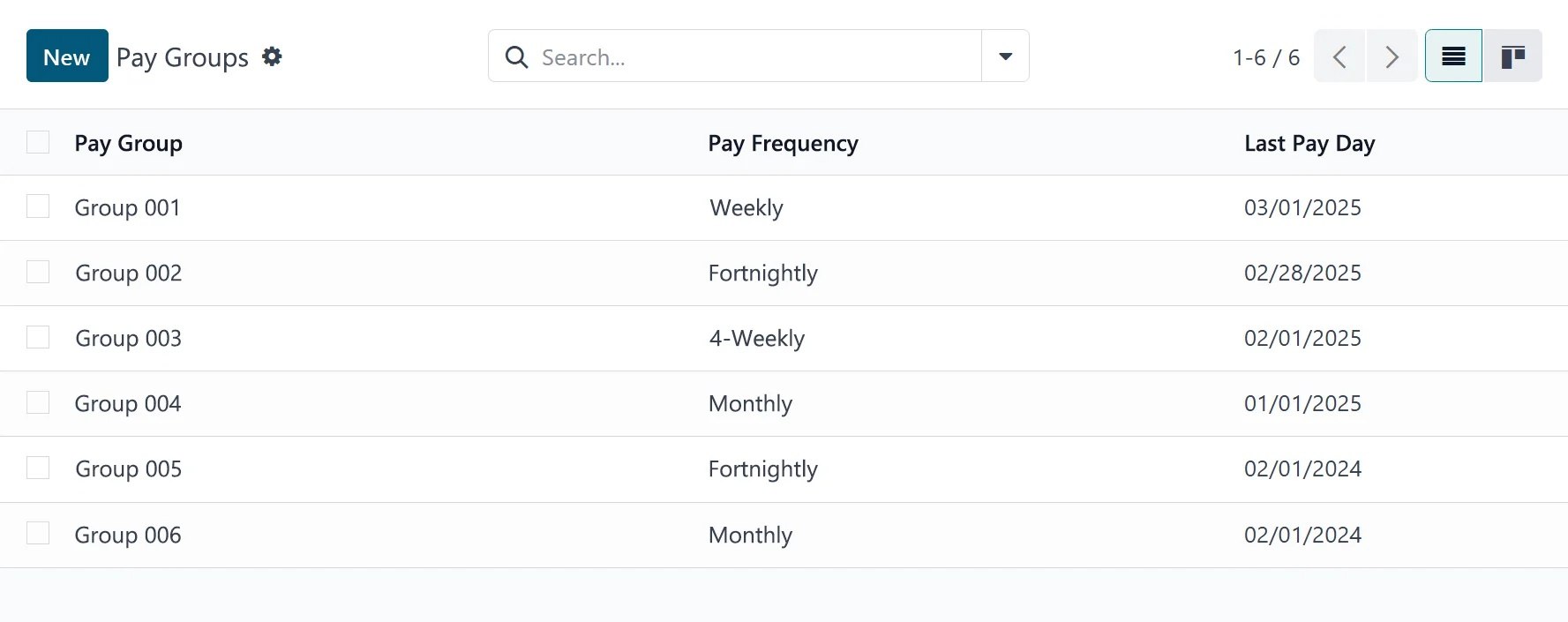

Track pay groups

Manage and track pay groups in your company, with details like pay frequency and paydays. Access specific pay group information easily, such as the number of employees in each group, annual working days, and pay schedules.

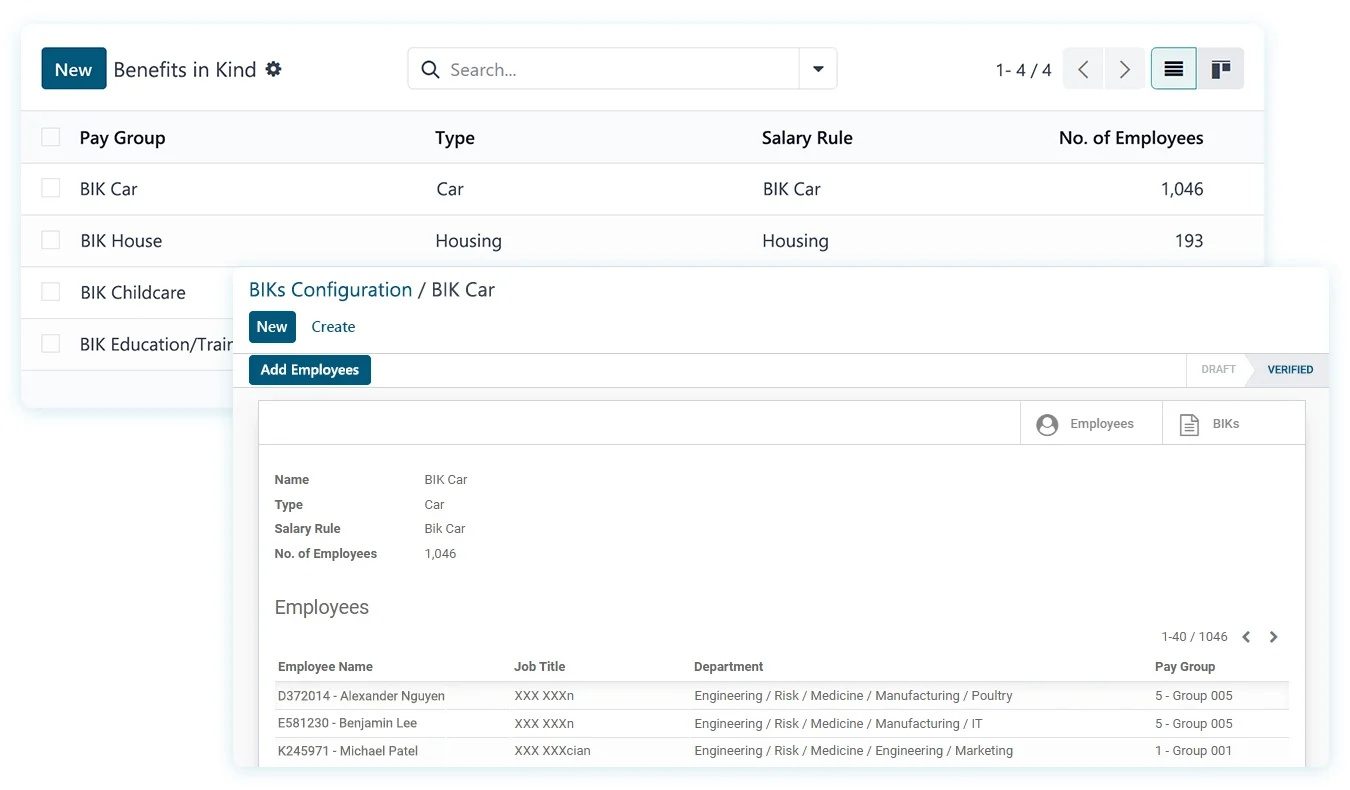

Configure benefits in kind

Manage non-cash benefits easily within the payroll app. View Benefits in Kind (BIK) details such as salary rules and employee counts. Access the list of employees in each BIK, along with their job titles, departments, and pay groups. Add or modify employees within each benefit type to maintain accuracy.