Managing Loans with Odoo Accounting

Odoo 18 Accounting simplifies the management of loans tied to business assets such as real estate, machinery, or vehicles. By linking loans directly to specific assets, it ensures that financial obligations associated with these assets are clearly tracked and visible. This allows businesses to maintain an organised financial structure and provides transparency in loan management.

Additionally, users can generate detailed reports to analyse loan performance, repayment progress, and interest costs. These insights enable informed decision-making while improving financial control and reducing the manual effort involved in managing asset-linked loans.

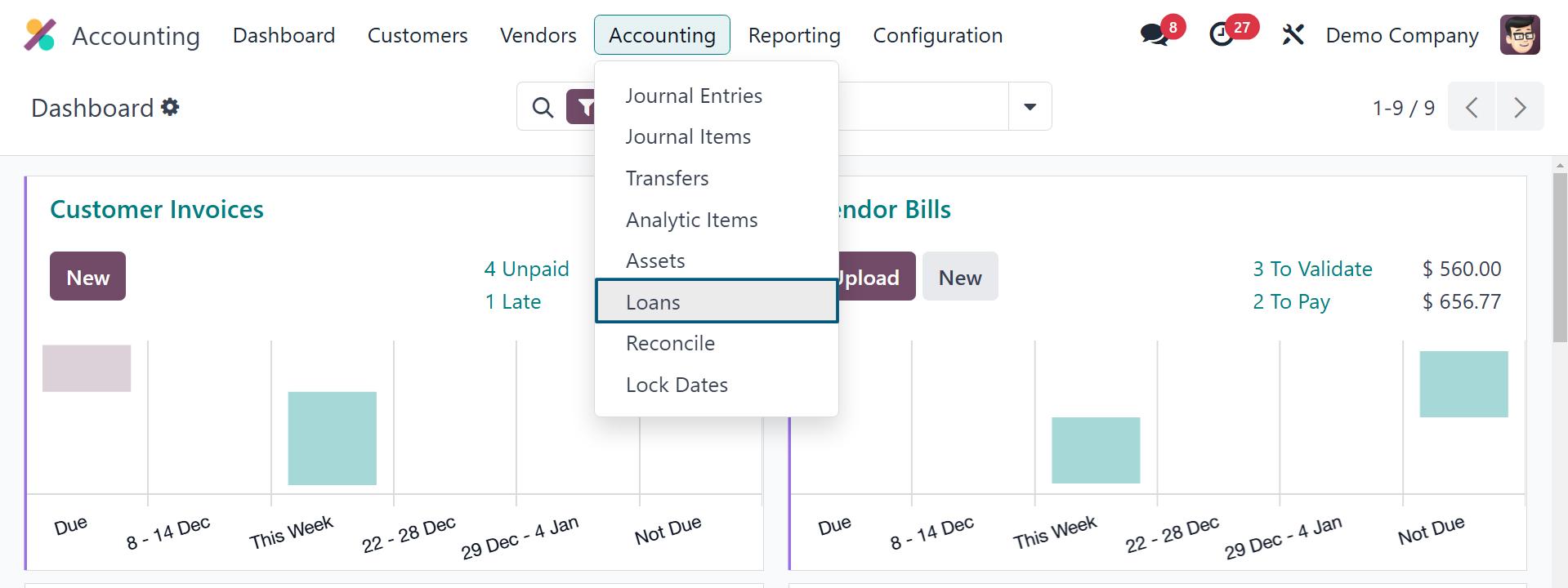

Exploring the Loans Section in Odoo Accounting

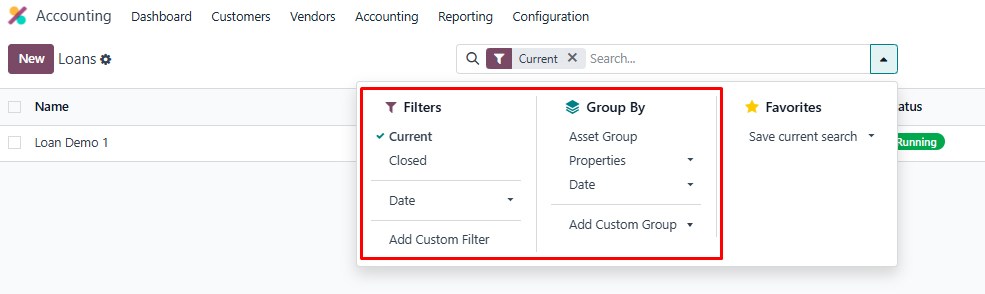

To explore how Loan Management is handled in Odoo 18 Accounting, navigate to the Accounting menu within the module. Under this menu, you will find the Loans section, as displayed in the screenshot below.

In the Loans section, you can view the following details in the loan list:

- Loan Name

- Start Date

- End Date

- Amount Borrowed

- Outstanding Balance

- Status

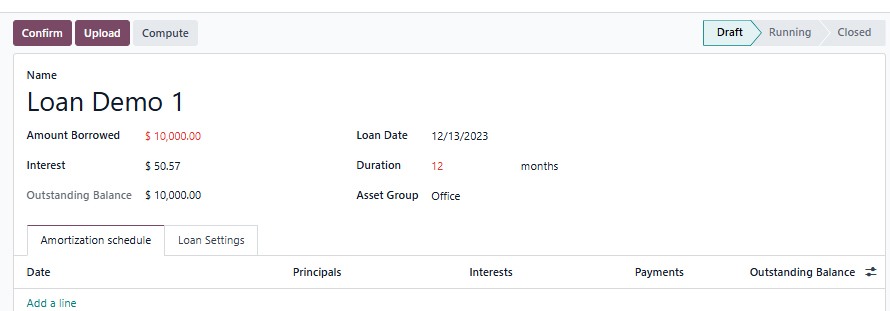

Adding a New Loan

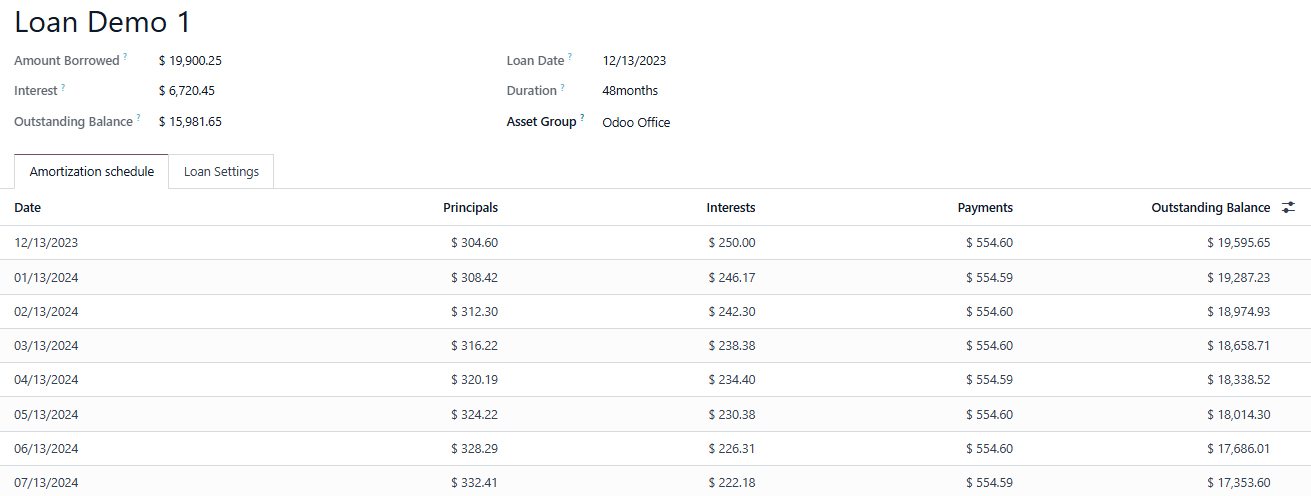

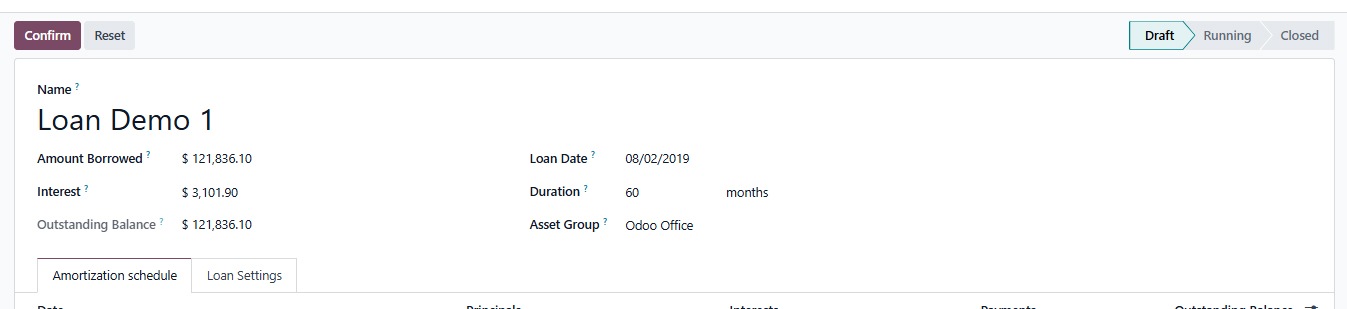

To add a new loan, click on the New button. This action opens the Loan Creation Form, where you can input the necessary details as outlined below:

- Loan Name: Provide a unique and descriptive name for the loan.

- Amount Borrowed: Enter the total amount borrowed for the loan.

- Interest: Specify the interest rate applicable to the loan.

- Loan Date: Mention the date on which the loan was initiated.

- Duration of Loan: Set the repayment period or duration for the loan.

- Outstanding Balance: This field will auto-populate based on repayments and interest adjustments.

- Asset Group: Link the loan to the appropriate asset group (e.g., real estate, machinery, vehicles).

Once all the required fields are filled, save the loan record. This structured form ensures accurate tracking of financial obligations and links loans to the corresponding assets.

Amortisation Schedule

The Amortisation Schedule provides a detailed breakdown of loan payments, showing:

- Principal and Interest Components

- Total Amount Owed Over Time

This schedule ensures clarity on repayment plans and loan dynamics. Users can manage this schedule in two ways:

- Manual Entry: Use the Add a Line button to input payment details for each installment.

- Automatic Generation: The schedule can be auto-filled based on the selected Compounding Method (e.g., monthly, quarterly).

This flexibility allows businesses to adapt schedules to specific loan agreements or make adjustments as needed.

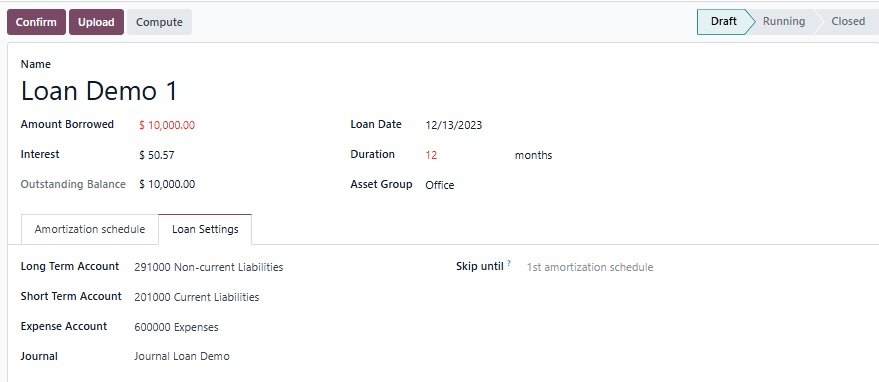

Loan Settings

The Loan Settings tab is essential for configuring financial accounts linked to the loan. Here, you set up the following:

- Journal: Select the journal where loan-related transactions will be recorded.

- Expense Account: Specify the account for recording interest payments and loan expenses.

- Long-Term Account: Define the account to track the loan as a long-term liability.

- Short-Term Account: Specify the account for short-term liabilities if portions of the loan fall due within a year.

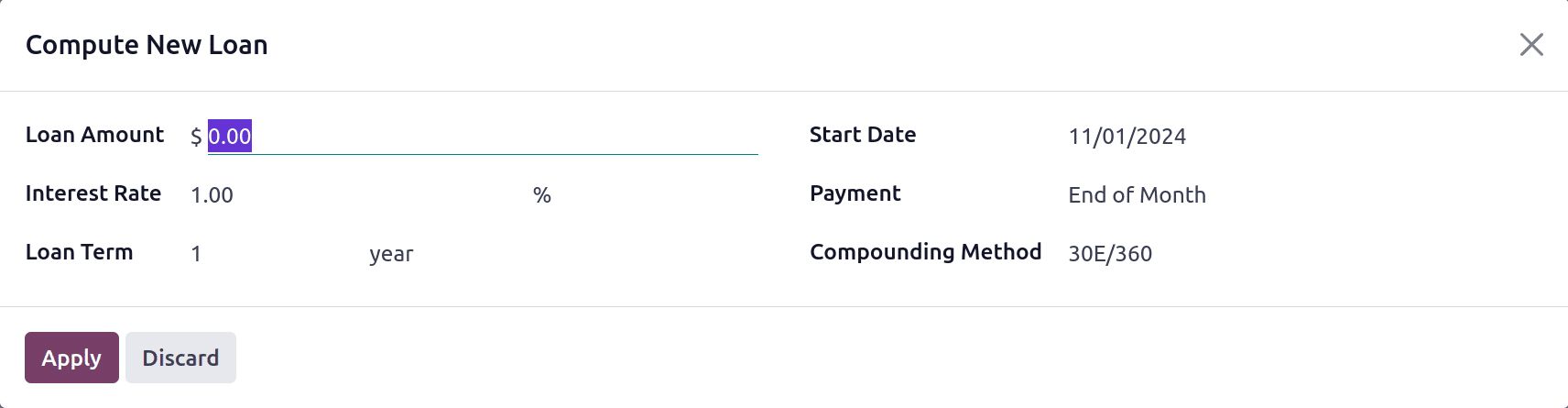

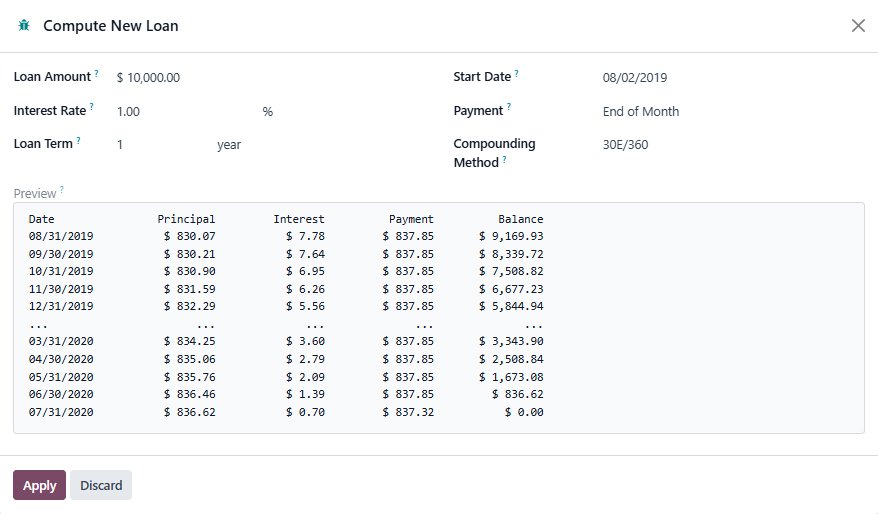

Odoo provides an option to prevent automated entries for loan lines up to a specified date. When the Compute button is clicked, Odoo opens a detailed configuration window for loan computation. This window allows users to define key parameters of the loan, ensuring accurate calculations.

The Compounding Method is a critical element in determining how interest accrues on a loan. Based on the selected method, Odoo generates a preview of the amortisation schedule, providing a clear breakdown of payments.

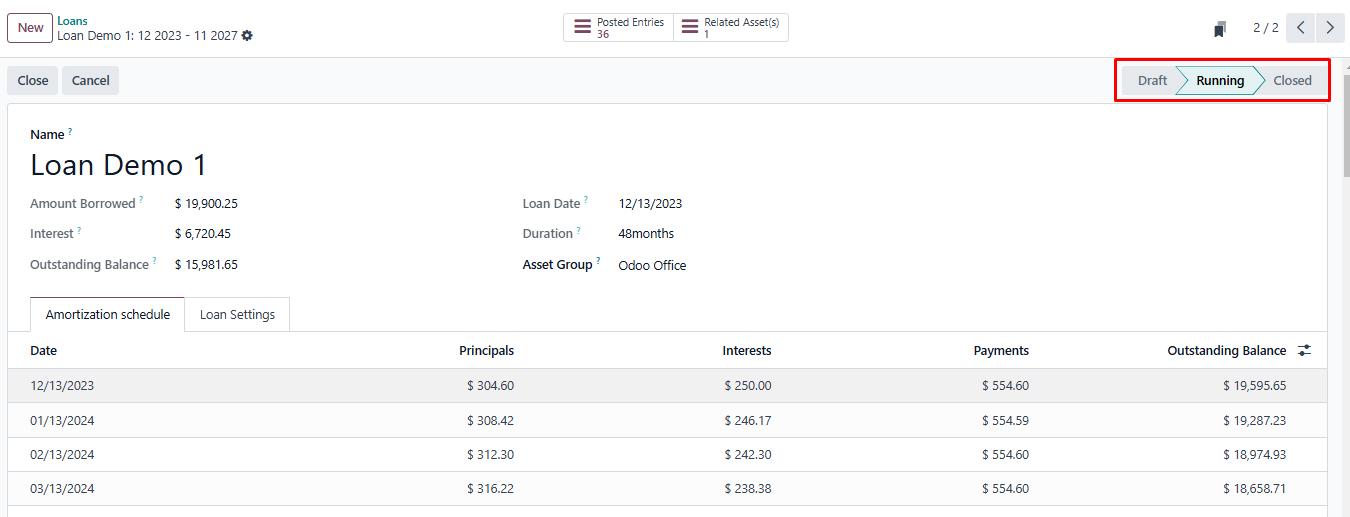

Once satisfied, click the Confirm button located at the top of the loan form. This action finalises the loan configuration and locks the settings to prevent accidental edits.

After clicking Confirm, the loan status changes from Draft to Running.

Open the smart tab to check the journal entries.

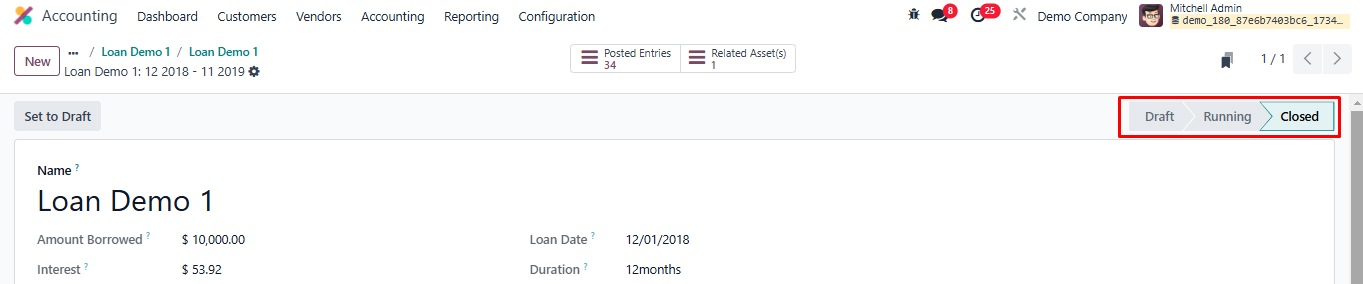

Loan Closure

Once the loan has been fully repaid or settled, the loan stage will automatically change to Closed. This means the loan is fully completed, and all financial obligations are satisfied.

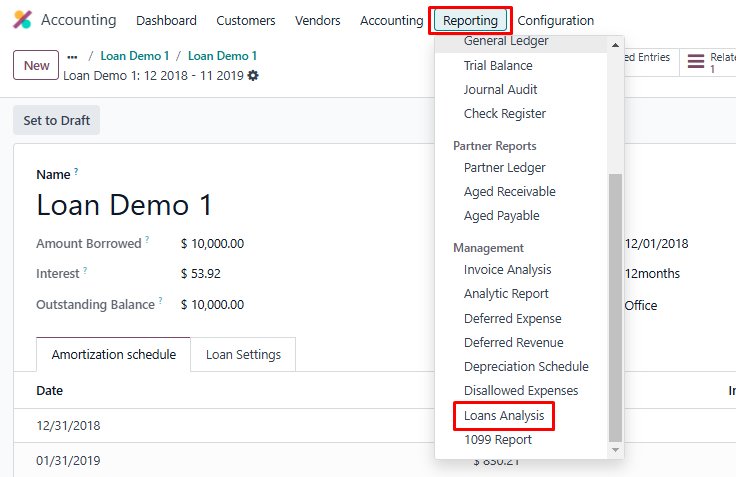

Loan Analysis Report in Odoo 18

The Loan Analysis Report in Odoo 18 Accounting provides a detailed overview of how loans are performing, offering businesses critical insights into:

- Outstanding balances

- Accrued interest

- Repayment statuses

This report helps organisations monitor the progress of loans, assess their impact on cash flow, and track their balance sheets. Go to Reporting > Loan Analysis to access these insights.

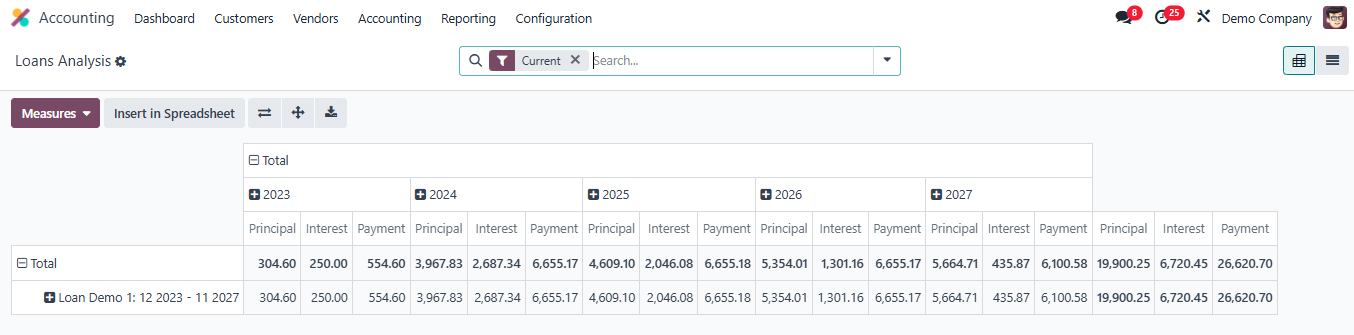

In Odoo 18 Accounting, the Loan Analysis Report is initially displayed in Pivot View, which provides a clear and interactive overview of your loans.

In addition to the Pivot View, Odoo 18 Accounting also offers a List View of the Loan Analysis Report. This view provides a detailed, tabular layout of all loans, offering users flexibility in organising and analysing loan data.

Odoo 18 Accounting's Loan Management feature significantly streamlines the process of managing loans related to business assets. By automating key tasks in load management, it saves time and reduces the risk of errors.