Ensuring Accurate Payroll Processing

Effective payroll management is crucial for businesses, especially when handling complex structures with multiple cost centres and project-specific employees. At Numla, we ensure that payroll processing for our clients is done accurately, efficiently, and in compliance with financial regulations. This Standard Operating Procedure (SOP) outlines the step-by-step process that Numla follows to handle payroll for its clients, ensuring accurate and efficient payroll management.

Scope of SOP

This SOP applies to all personnel involved in the payroll processing at Numla, including data entry, analysis, and importation into the Odoo system.

Steps for Payroll Processing

This SOP applies to all personnel involved in the payroll processing at Numla, including data entry, analysis, and importation into the Odoo system.

1. Initial Data Preparation

The process begins when payroll data is received from the client. This data typically includes employee details, salary breakdowns, allowances, and deductions.

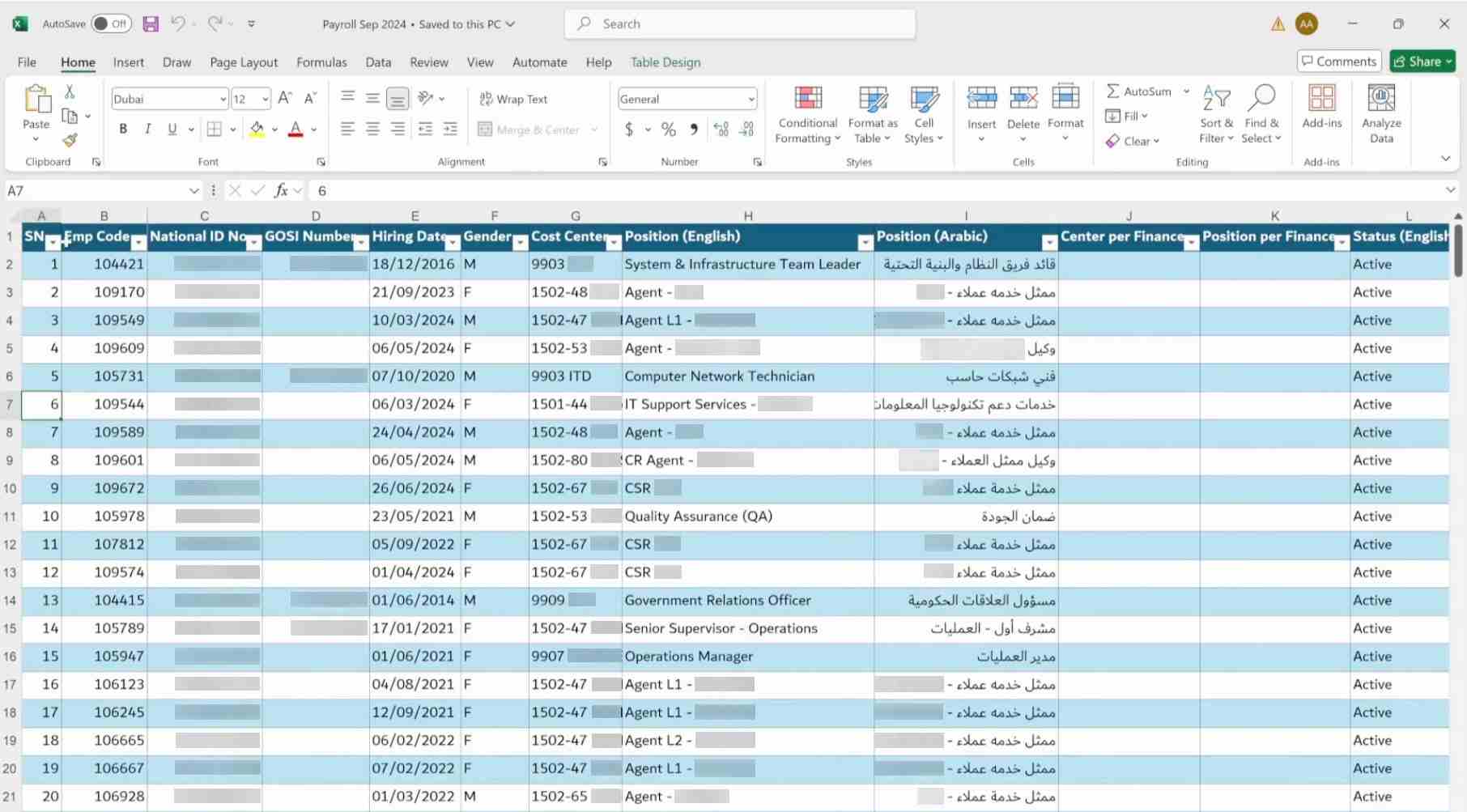

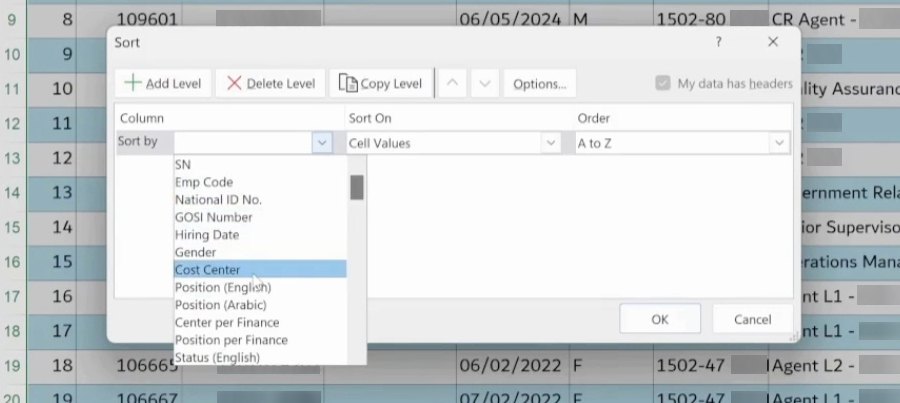

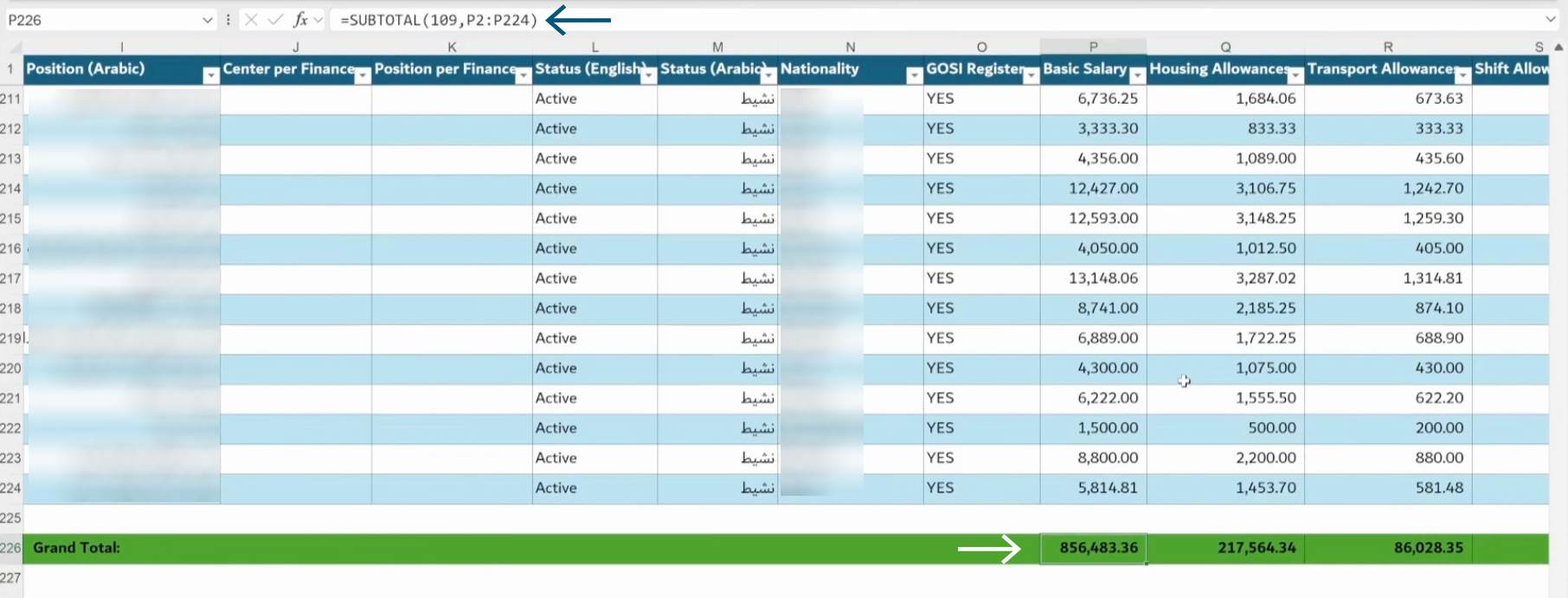

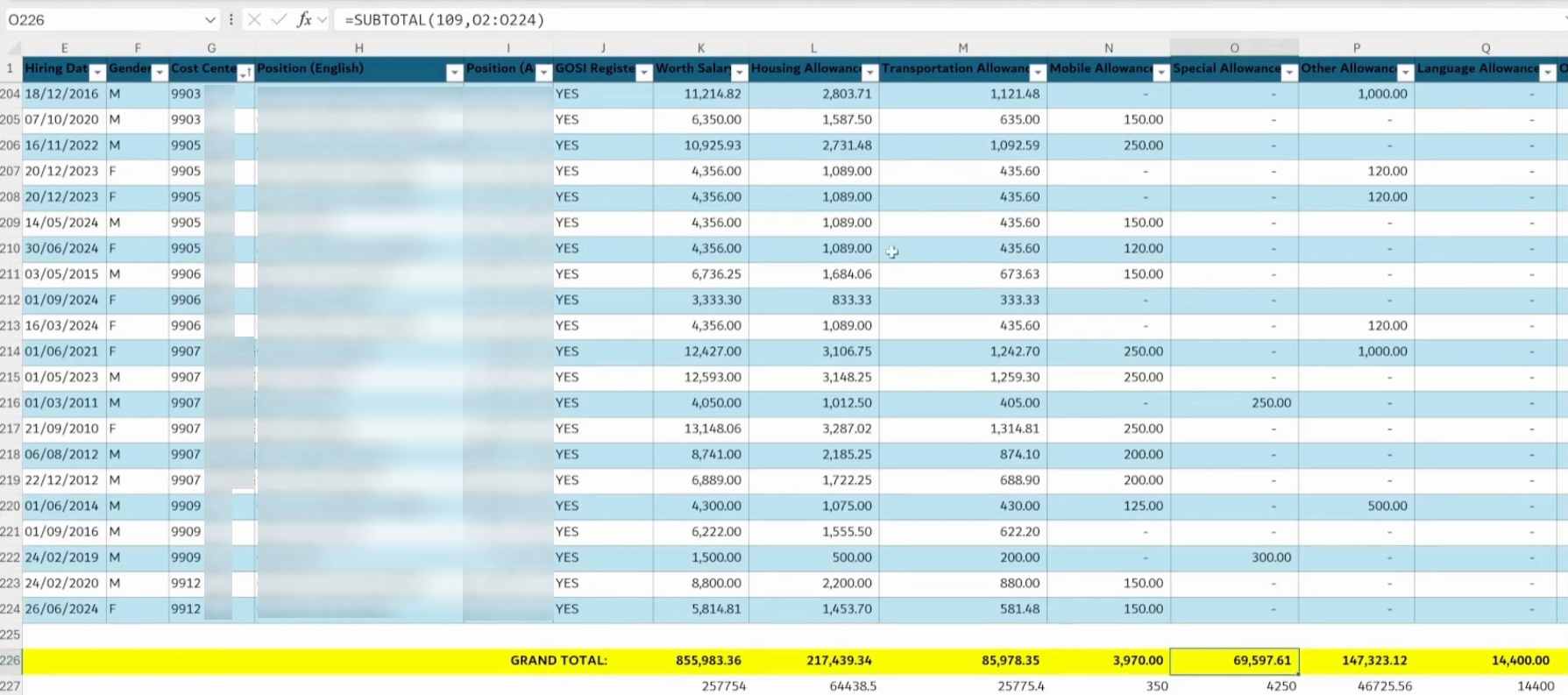

Sort Data by Cost Center

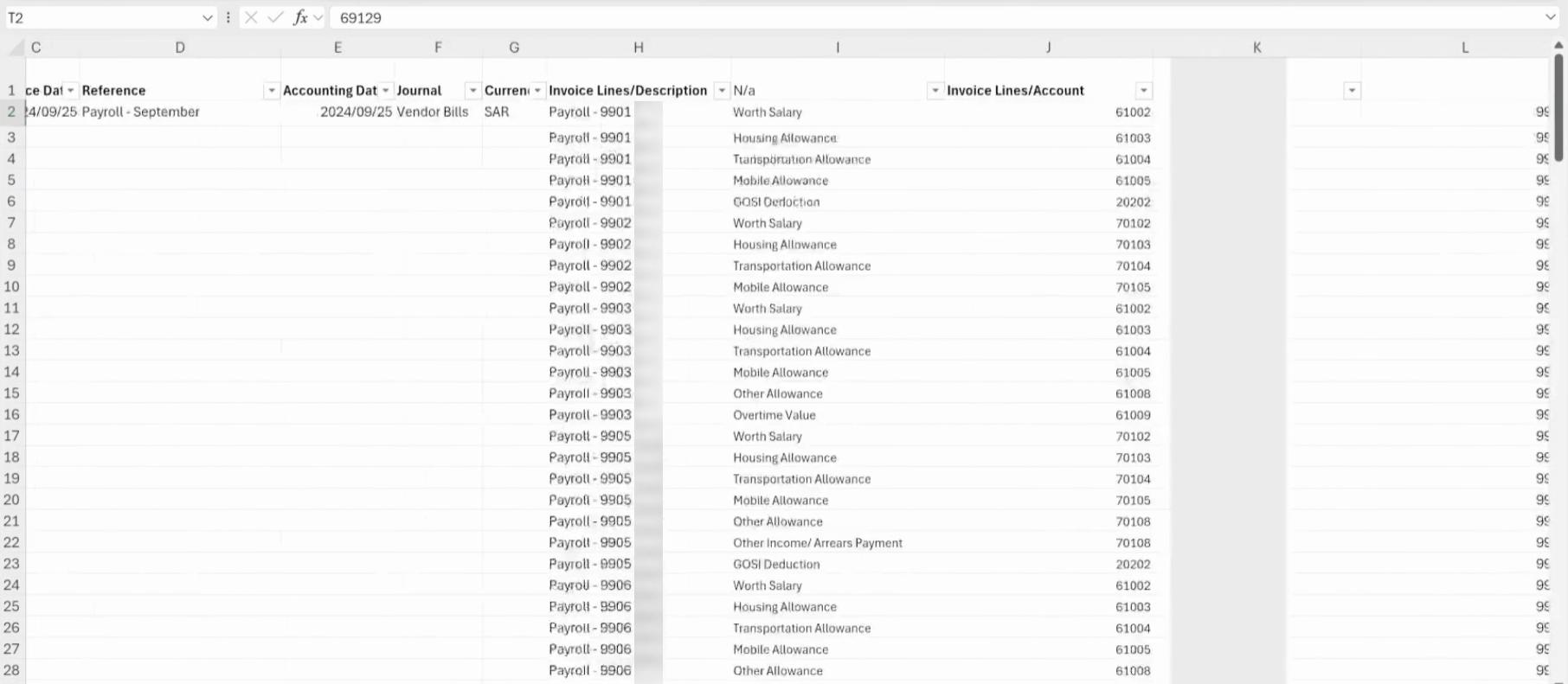

To ensure organised tracking, the data is sorted based on the client's cost centres, such as project-based codes (e.g., 1501, 1502) or corporate departments (e.g., 9901 for corporate employees). Sorting by cost centre helps to align payroll processing with the client’s accounting structure.

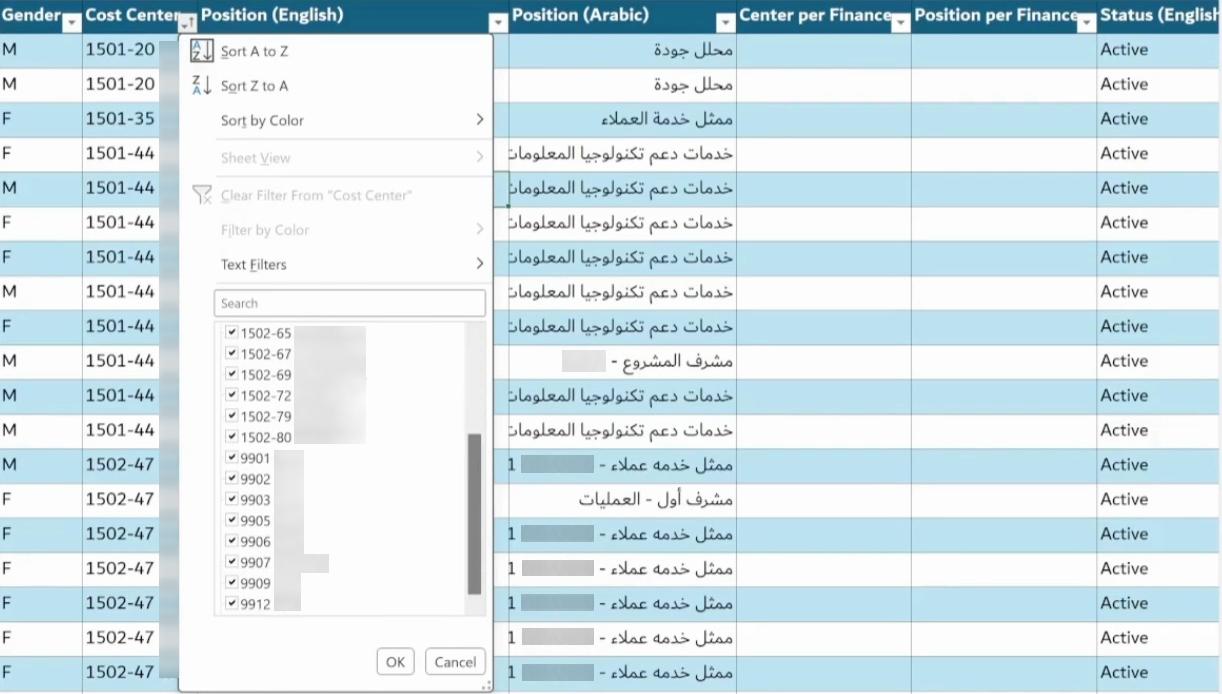

2. Calculate Payroll Totals

Subtotal formulas (e.g., SUBTOTAL (109, range)) are used to calculate payroll components like basic salary, transportation allowances, and housing allowances accurately.

It is always ensured that formulas are applied correctly to avoid discrepancies in salary and benefit calculations.

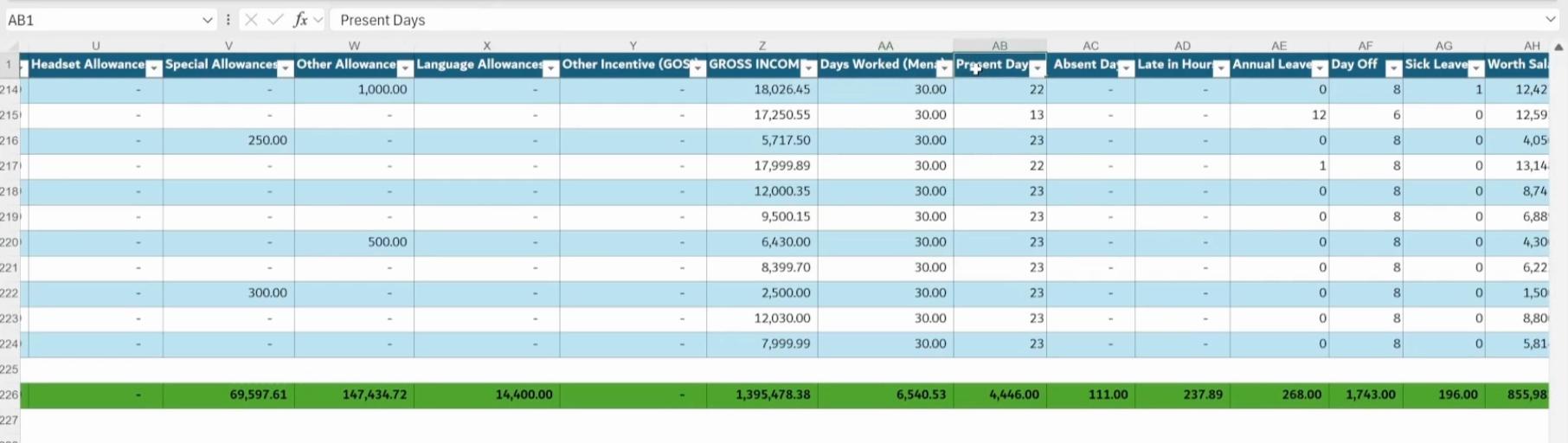

3. Data Formatting for Odoo

Once totals are calculated, the data is formatted into an Excel sheet for importing into Odoo. Columns with nil values (e.g., allowances with no balance) are removed. Irrelevant or non-monetary data, such as "days worked" or "sick leave," is removed to focus on monetary amounts.

Delete unnecessary columns, such as "gross income" or non-monetary values that do not provide value for payroll processing, before proceeding. This ensures that only the necessary payroll data is imported into Odoo.

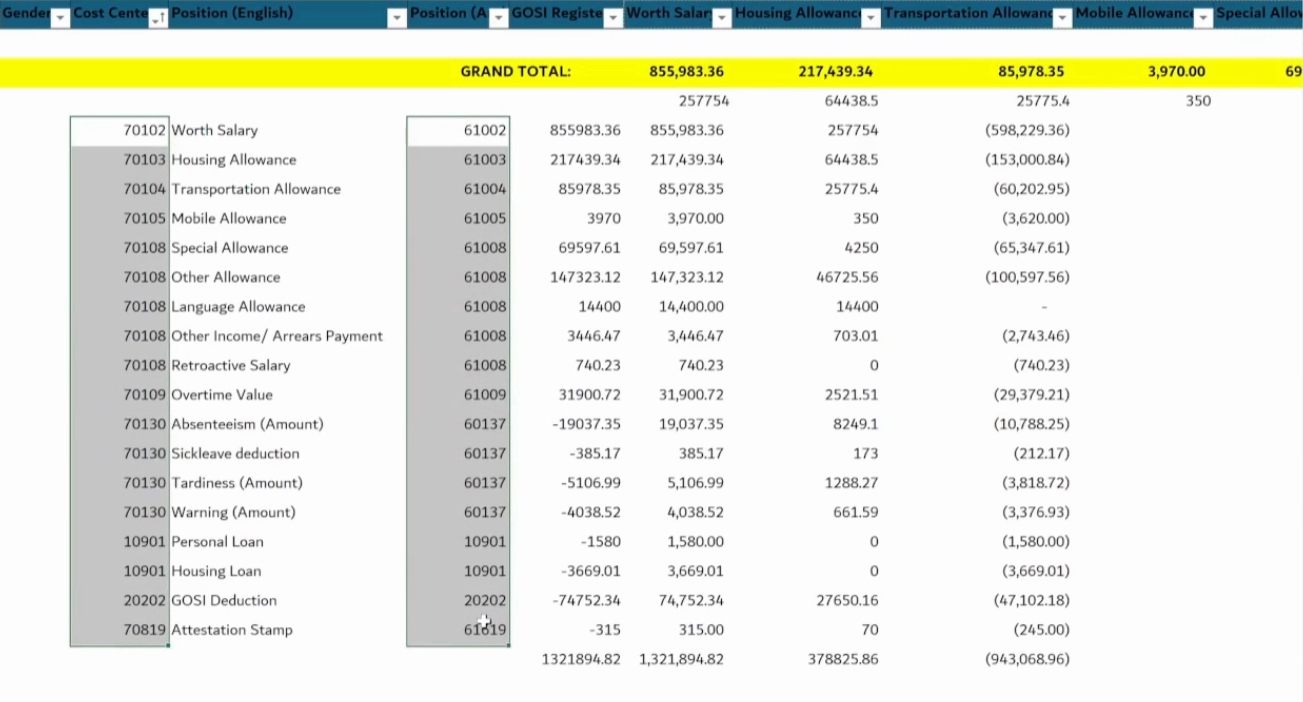

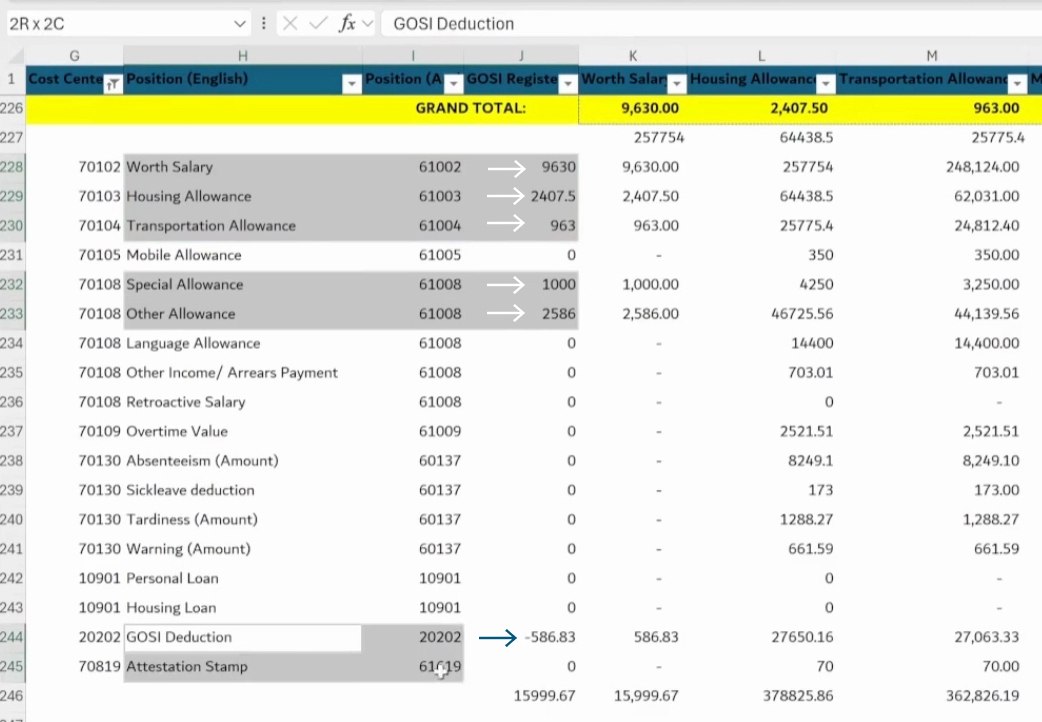

4. Map Allowances to Account Numbers

Each payroll element, such as allowances or deductions, is assigned to the appropriate account numbers (e.g., 6-series for projects and 7-series for corporate costs). This ensures that payroll data aligns with the client’s financial reporting structure.

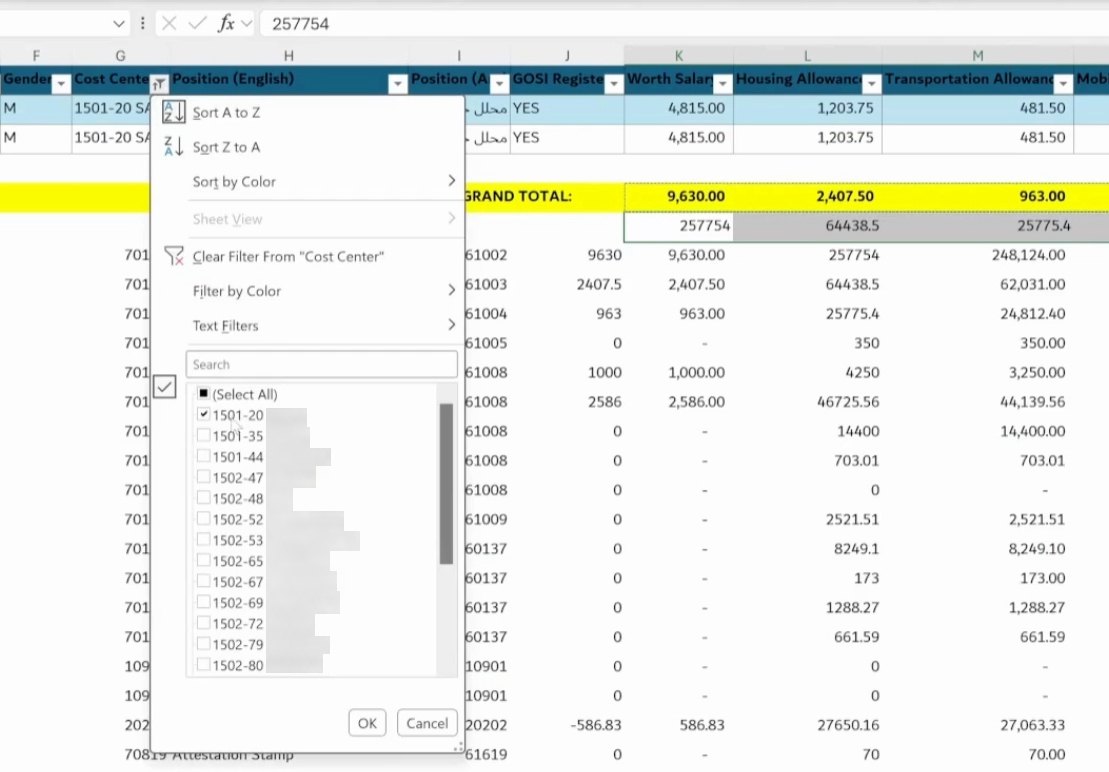

5. Filter Data by Project

For clients managing payroll across multiple projects, the data is filtered by specific projects. This allows us to ensure that the payroll for each project is correctly calculated and organised.

For each project, positive values represent amounts to be paid, while negative values represent deductions.

6. Transfer Data to Project-Specific Sheets

Once the data has been filtered, it is copied into the corresponding project sheets in the prepared format. These sheets are reviewed for accuracy before merging them into a single payroll file for the client.

7. Finalising the Payroll File

All project sheets are combined into a single payroll file. At this stage, the totals are cross-checked against the initial payroll data received to ensure accuracy.

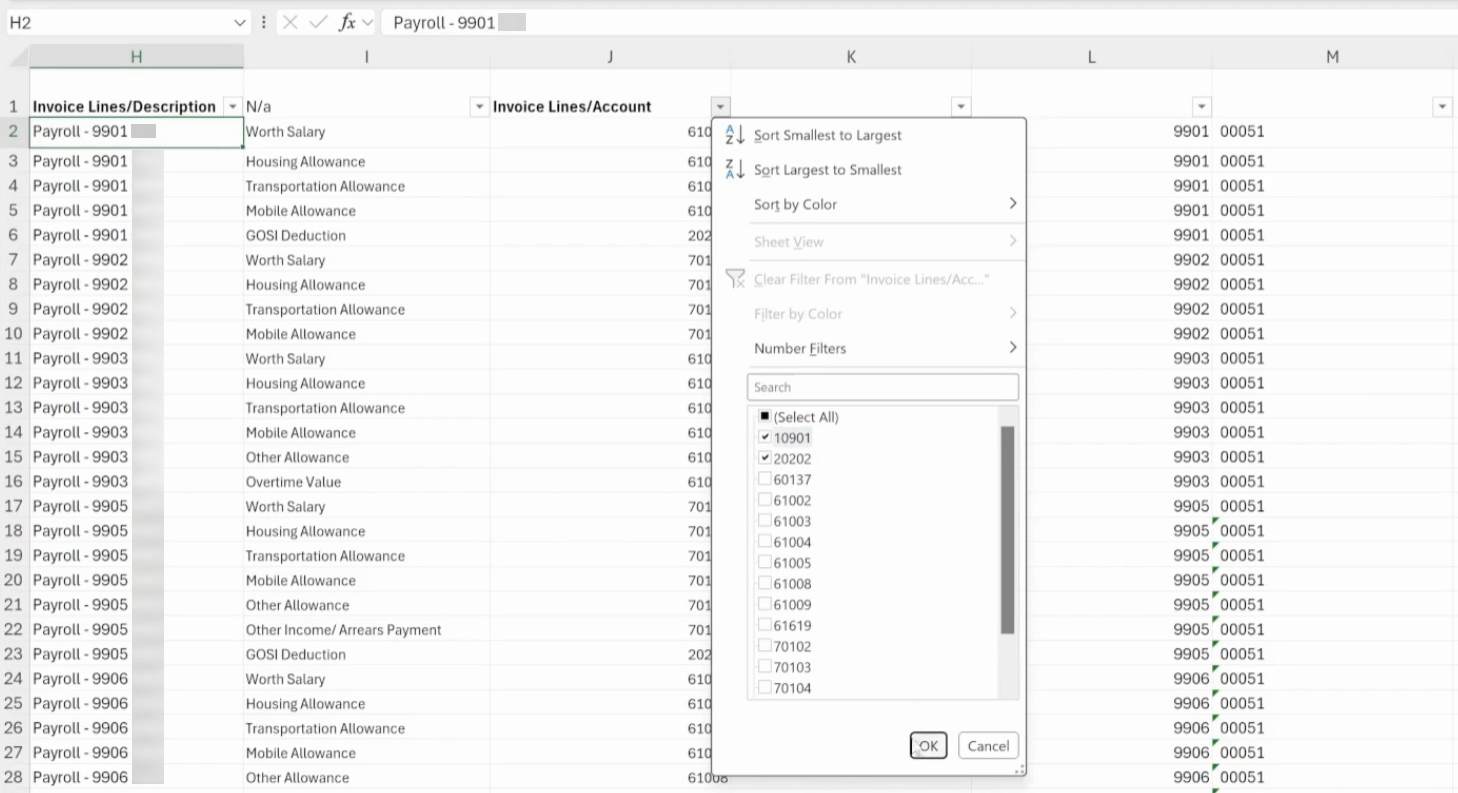

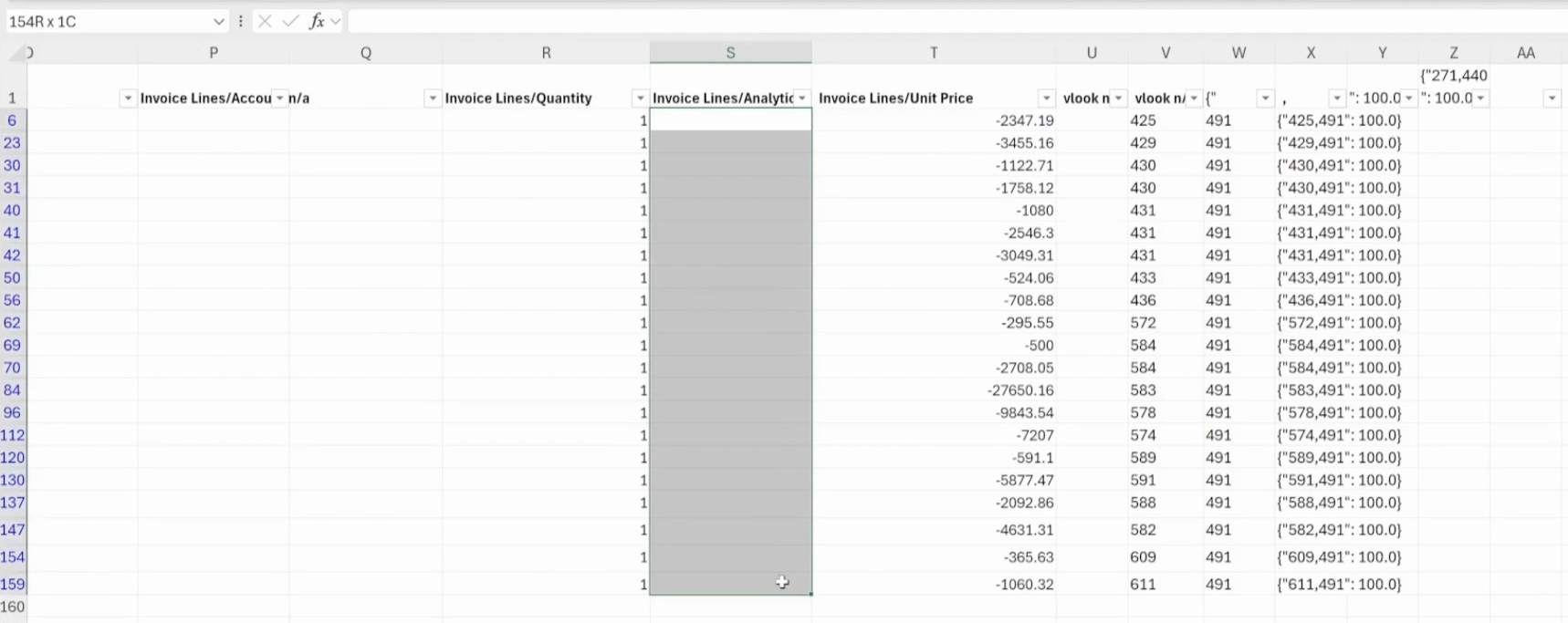

8. Removing Analytical Accounts

Analytical accounts (from 1-series and 2-series) that are not applicable for payroll processing are removed. This ensures that the data being imported into Odoo is clean and free of unnecessary information.

9. Final Review and Confirmation

Before proceeding with the final payroll submission, the following are verified:

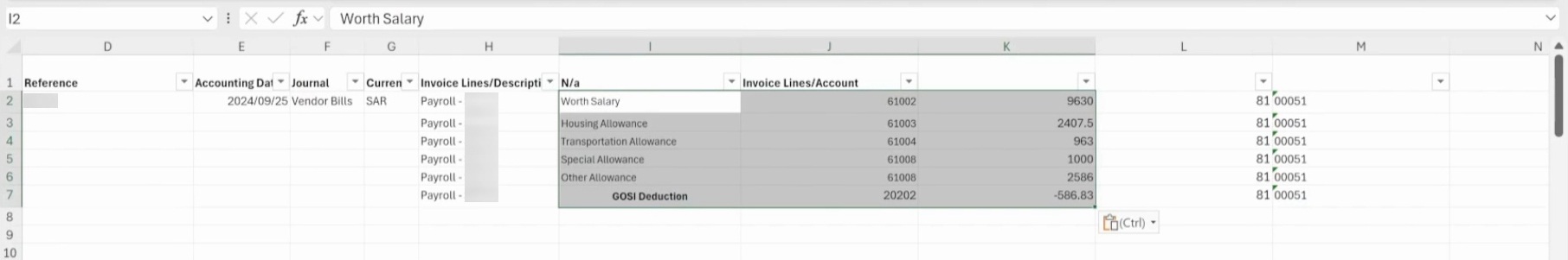

- The invoice date and currency (e.g., SAR) are checked for accuracy.

- Analytical codes are reviewed to ensure they align with the relevant projects.

- Totals are cross-checked.

- A final check confirms that no analytical accounts remain for the one- and two-series accounts.

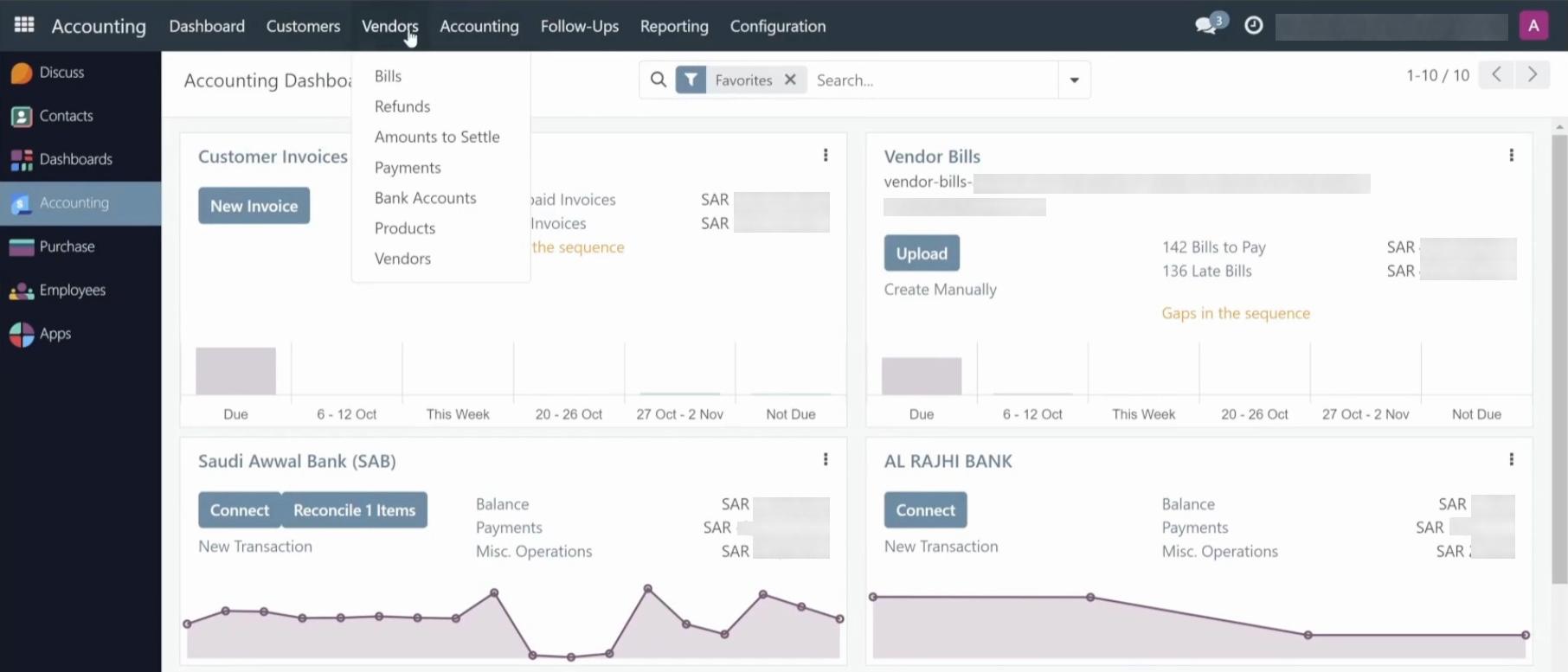

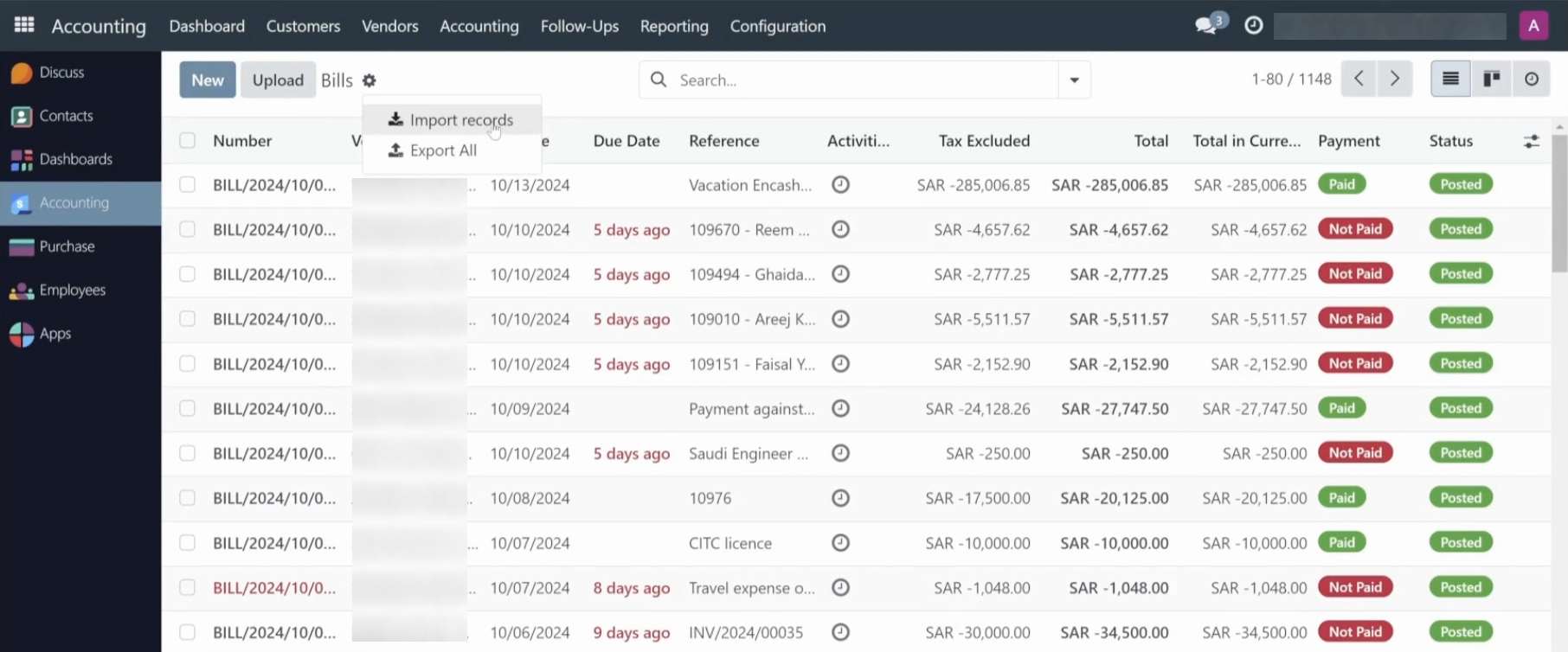

10. Import the Payroll File to Odoo

Finally, the payroll file is imported into Odoo under the "Vendor Bills" section, using the import feature. This creates draft records for review.

After the import, draft entries are reviewed to ensure all data is correct. Once confirmed, the payroll is posted, completing the process.

Final Thoughts

Following this SOP ensures that payroll processing at Numla is efficient, accurate and also compliant with financial regulations. By adhering to these steps, we consistently deliver accurate payroll services to our clients, no matter the complexity of their organisational structure.