Tracking Currency Gains and Losses

Exchange rates can shift daily, and those shifts affect the value of invoices that are still unpaid. For businesses operating across borders, this creates unrealized currency gains or losses that must be tracked. The Unrealized Currency Gains/Losses Report makes this process automatic, accurate, and compliant.

What is an Unrealized Currency Gain or Loss?

An unrealized currency gain or loss occurs when the value of a foreign currency invoice changes due to exchange rate fluctuations before the invoice is paid or reconciled.

Unrealized Gain

This happens when the exchange rate moves in your favour. For example, you issue an invoice for 1,000 EUR when the exchange rate is $1.10/EUR (invoice value: $1,100). When you're preparing your financial statements, the exchange rate has increased to $1.15/EUR. The value of your receivable has now increased to $1,150, resulting in an unrealized gain of $50.

Unrealized Loss

This occurs when the exchange rate moves against you. Using the same example, if the exchange rate drops to $1.05/EUR, the value of your receivable is now only $1,050, leading to an unrealized loss of $50.

Payables Example

If you owe a supplier 1,000 EUR, and the rate increases from $1.10/EUR to $1.15/EUR before payment, your liability increases from $1,100 to $1,150, an unrealized loss on your side.

These gains and losses are "unrealized" because the transaction hasn't been completed yet. They are temporary, and their final value will only be determined once the payment is made. However, they need to be accounted for on your balance sheet to accurately reflect the true value of your assets and liabilities.

Why Use Unrealized Currency Gains/Losses Report?

The Unrealized Currency Gains/Losses Report is designed to automatically calculate and generate a report of these fluctuations for all open foreign currency invoices and bills. Here's what it does for you:

Automated Calculation

Instead of manually tracking and calculating the value of each foreign currency transaction, the report does the heavy lifting. It takes the original exchange rate at the time of the transaction and compares it to the current exchange rate you have configured in your system.

Accurate Financial Reporting

By identifying and posting these unrealized gains or losses, the report ensures your balance sheet accurately reflects the current value of your receivables and payables. This is essential for compliance with accounting standards (like GAAP or IFRS) and for providing stakeholders with a true picture of your company's financial health.

Proactive Financial Management

The report provides valuable insights into your foreign currency exposure. By regularly reviewing this report, you can identify potential risks and opportunities. For example, a large unrealized loss might prompt you to consider hedging strategies to mitigate future risks.

Generating Unrealized Gains/Losses Report in Odoo

Using the Unrealized Currency Gains/Losses Report in Odoo is straightforward:

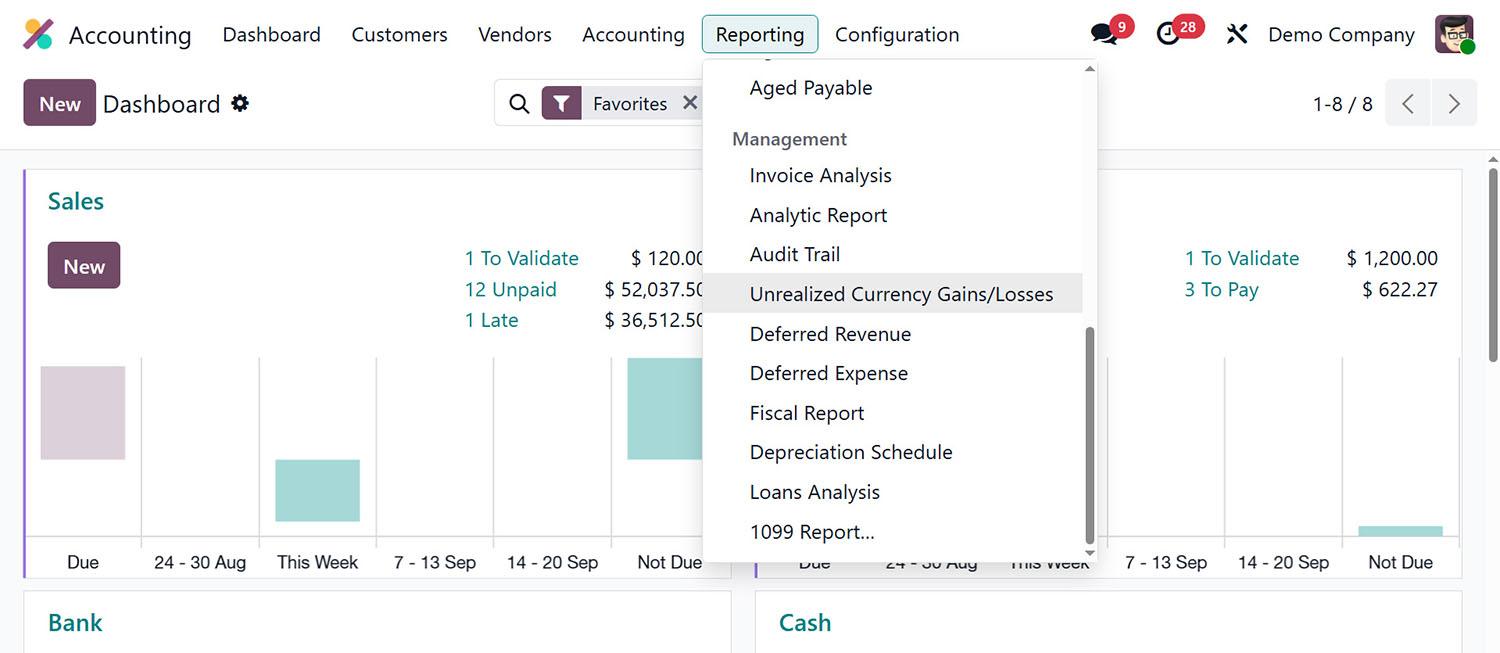

Access the Report

Open the Accounting app and go to the Reporting menu. There, you’ll see the Unrealized Currency Gains/Losses report.

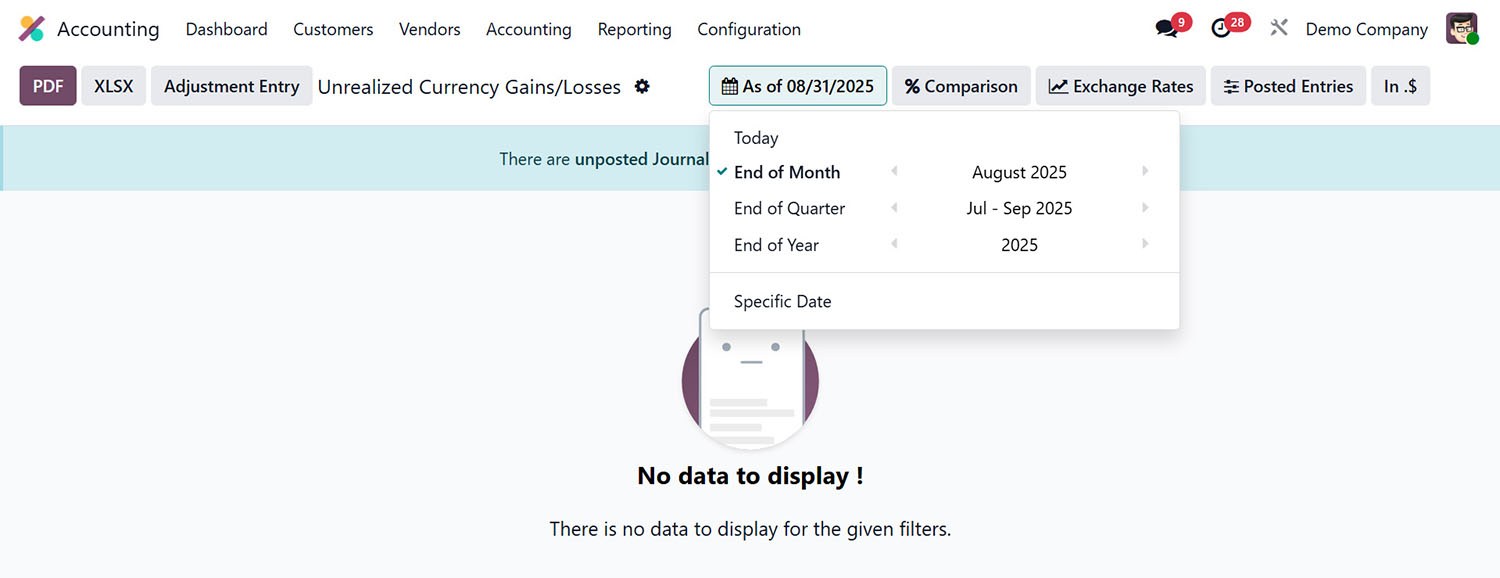

Set the Date

The report is generated for a specific date. This is usually the end of a fiscal period, such as a month, quarter, or year. The system uses the exchange rate valid on that date to calculate differences.

Generate and Review

After you set the date, the system generates the report. It shows each open invoice or bill in a foreign currency, the original value, the value at the reporting date, and the unrealized gain or loss. The report also asks for a reversal date, typically one day before the next posting of journal entries.

Post the Journal Entry

The report provides a button to "Post Journal Entries." Clicking it creates a journal entry to record the unrealized gains and losses. This entry typically debits or credits a "Unrealized Gains/Losses" account on your income statement and adjusts the value of the corresponding accounts receivable or payable.

Important Considerations

Currency Rates

The accuracy of this report depends entirely on the accuracy of your currency exchange rates in the system. Ensure you have a reliable method for updating these rates, either manually or through an automated service.

Balance Sheet Impact

After posting the journal entry, you will notice that the value of your receivables and payables on the balance sheet has been adjusted to reflect the current market value.

Realized vs. Unrealized

It's crucial to understand the difference. When the invoice is finally paid, the system will automatically calculate and post the realized gain or loss, which is the final profit or loss from the currency fluctuation.

Final Thoughts

For companies operating internationally, the Unrealized Currency Gains/Losses Report is not just another feature, it is essential. It automates complex accounting tasks, ensures compliance, and gives management an accurate financial picture. By making it part of your regular financial reporting, you can confidently navigate the complexities of foreign currency transactions and maintain accurate, up-to-date financial records.